Trading and investing in the UK financial landscape bring abundant opportunities. To fully capitalise on them, strategic awareness and staying updated with your traded asset class are imperative. Trading and investment apps have become invaluable tools, offering reliability in managing positions at your convenience. Today, we shed light on the best apps for trading and investing, sparing you the laborious market research task. Remember, the key to success in this financial landscape lies in making the best decisions and choices, and TradingGuides experts are here to help.

Essence

- Trading and investing in the UK is skyrocketing, but how you navigate this activity determines your success potential.

- The best investment apps UK for beginners should be licensed and overseen by the Financial Conduct Authority (FCA) for maximum safety.

- At TradingGuide, we take our research process seriously before making any recommendations to our readers.

- Always understand the asset you want to trade or invest in before putting up your money.

- Trading and investes, commodities, cryptocurrencies, indices, and more.

- Traders should apply risk management controls and consider portfolio diversification to mitigate massive losses.

- Most investments apps UK allows you to apply leverage in your trades, thus maximising potential profits*.

- In the UK, all profits from trading and investing in the financial must be subjected to capital gains tax by the HM Revenue & Customs (HMRC).

*Your capital is at risk.

List of the Best Trading and Investment Apps in the UK

- eToro – Best Investment App for iOS

- Plus500* – Top-Tier Trading and Investment App

- Capital.com – One of the Best With Excellent Support Service

- Pepperstone – One of the Cheapest Options

- Spreadex – Best Trading App With Spread Betting Options

- FxPro – Best Trading App For MetaTrader Users in the UK

*76% of CFD retail accounts lose money

How We Choose Trading & Investment Apps

We conduct comprehensive market research and analysis before making any recommendations on this page. Leveraging our extensive experience as professional traders and researchers spanning decades, we initiate the process by gathering a comprehensive list of FCA-regulated apps. This step ensures that we only consider platforms that meet stringent regulatory standards for security and reliability.

Subsequently, we sign up for demo trading accounts across these platforms. Through rigorous testing, we evaluate their performance and compare their features to identify the most optimal options available in the market.

Our research methodology extends beyond mere performance evaluation. We scour user testimonials and ratings on platforms across Google Play, the App Store, and Trustpilot. By incorporating feedback from actual users into our assessment, we gain invaluable insights into the user experience and overall satisfaction levels.

Overall, our methodology for choosing and recommending the best trading and investment apps UK is strict. This is because we want to remain unbiased in our research process so you only get the best of the best.

Compare the Best Trading & Investment Apps

As mentioned above, we test and compare as many trading and investment apps as possible in the UK. Some of the elements we look into are regulatory status, support service reliability, trade execution speed, and more. See the table below highlighting the features of our best investment apps UK for better decision making.

| Best App | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| eToro | FCA, CySEC, MFSA, FSRA, ASIC, FSAS, SEC, FINRA, AMF, OAM, Bank of Spain, FinCEN, GFSC | 24/5 | eToro investing platform, Multi-asset platform, WebTrader, Mobile App, ProCharts, CopyTrader™, Smart Portfolios, eToro Money Wallet | eToro Money, Credit/Debit cards, Bank transfer, PayPal, Neteller, Skrill, Trustly, iDEAL | Yes | Yes (up to $250,000) |

| Plus500 | FCA (FRN 509909), CySEC (#250/14), ASIC (#417727), MAS, FSA, SFSA, EFSA, DFSA, FSCA, FMA | 24/7 | Plus500 Webtrader, Mobile App, Plus500 Invest, Plus500 Futures | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Google Pay, Apple Pay | Yes | Yes (up to £85,000) |

| Capital.com | FCA, SCB, ASIC, CySEC, SCA | 24/7 | TradingView, MT4, Web platform, Mobile app | Bank transfer, bank cards, Apple Pay, TrueLayer | Yes | Yes (up to £85,000) |

| Pepperstone | FCA, ASIC, DFSA, SCB, CMA, CySEC, BaFin | 24/7 | MT4, MT5, cTrader, TradingView, Pepperstone Trading Platform | Apple Pay, Google Pay, Credit/debit cards, PayPal, Domestic bank transfer, International bank transfer | Yes | Yes (up to £85,000) |

| Spreadex | FCA | 24/5 | Spreadex’s Online Trading Platform, TradingView | Credit/Debit Cards, Bank transfer, Neteller, Apple Pay & Google Pay | No | Yes (up to £85,000) |

| FxPro | FCA, FSCA, SCB | 24/5 | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Wire Transfers, Credit/Debit Cards, PayPal, Neteller, Skrill | Yes | Yes (up to £85,000) |

Brief Overview of Our Recommended Trading Apps’ Fees and Assets

Having a trading and investing app meeting your needs is crucial in maximising your potential and experience. Among the factors to consider are the applicable fees and featured assets so you can plan accordingly before trading. Below, we have prepared tables showing our recommended trading apps’ fees and assets. Feel free to compare them and make a suitable choice.

Fees

| Best App | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| eToro | From 2 pips | $50 | $5 withdrawal | $10 monthly |

| Plus500 | From 0.0 pips | £100 | Free | £10 monthly |

| Capital.com | From 0.0006 pips | £20 | Free | £10 per month after 12 months of inactivity |

| Pepperstone | From 0.0 pips | £0 | Free | None |

| Spreadex | From 0.6 pips | £0 | Free | None |

| FxPro | From 0.1 pips | £100 | Free | £15 one-off maintenance fee |

Assets

| Best App | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| eToro | Yes | Yes | Yes | Yes | Yes |

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes |

| Capital.com | Yes | Yes | Yes | Yes | No |

| Pepperstone | Yes | Yes | Yes | Yes | No |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| FxPro | Yes | Yes | Yes | No | No |

Our Opinion & Overview of the Best Investment Apps in the UK

Identifying the best trading app in the UK is not easy, considering the lengthy research process involved. To simplify the process, we share below our opinion and overview regarding our experience with our recommended app. We aim to help you fully understand the strengths and weaknesses of these apps so you can make informed choices.

1. eToro – Best Investment App for iOS

eToro has proven to be one of the most sought out investment apps by UK investors. This is because it hosts various stock investments in the UK, including stocks and ETFs, all of which you can invest at a low fee.

eToro’s trading platform is another tool that impresses iOS users. Its intuitive design that is easy to use makes it suitable for all types of investors. This app also allows you to meet successful investors and copy their stock portfolios if you do not have the requisite skills.

Investing with eToro on your iOS device takes two forms. You can choose the right broker that lets you take total control of your investment activities or opt to pay the broker’s fee and let the professionals handle everything for you.

- Variety of instruments to invest in

- Copy feature for copying portfolios of expert investors

- Intuitive design and easy-to-use trading platform

- Complies with the conditions of the most strict authorities, including the FCA

- Educational and research tools are few

- No 24/7 customer service

| Types | Fee |

| Minimum Deposit | $50 |

| Conversion Fee | depends on your payment method, currency, and eToro Club level. |

| Overnight Fee | vary according to the value and direction (BUY or SELL) of your position |

| Withdrawal Fee | all withdrawal requests are subject to a $5 USD fee |

| Inactivity Fee | monthly inactivity fee of $10 USD (charged after 12 months) |

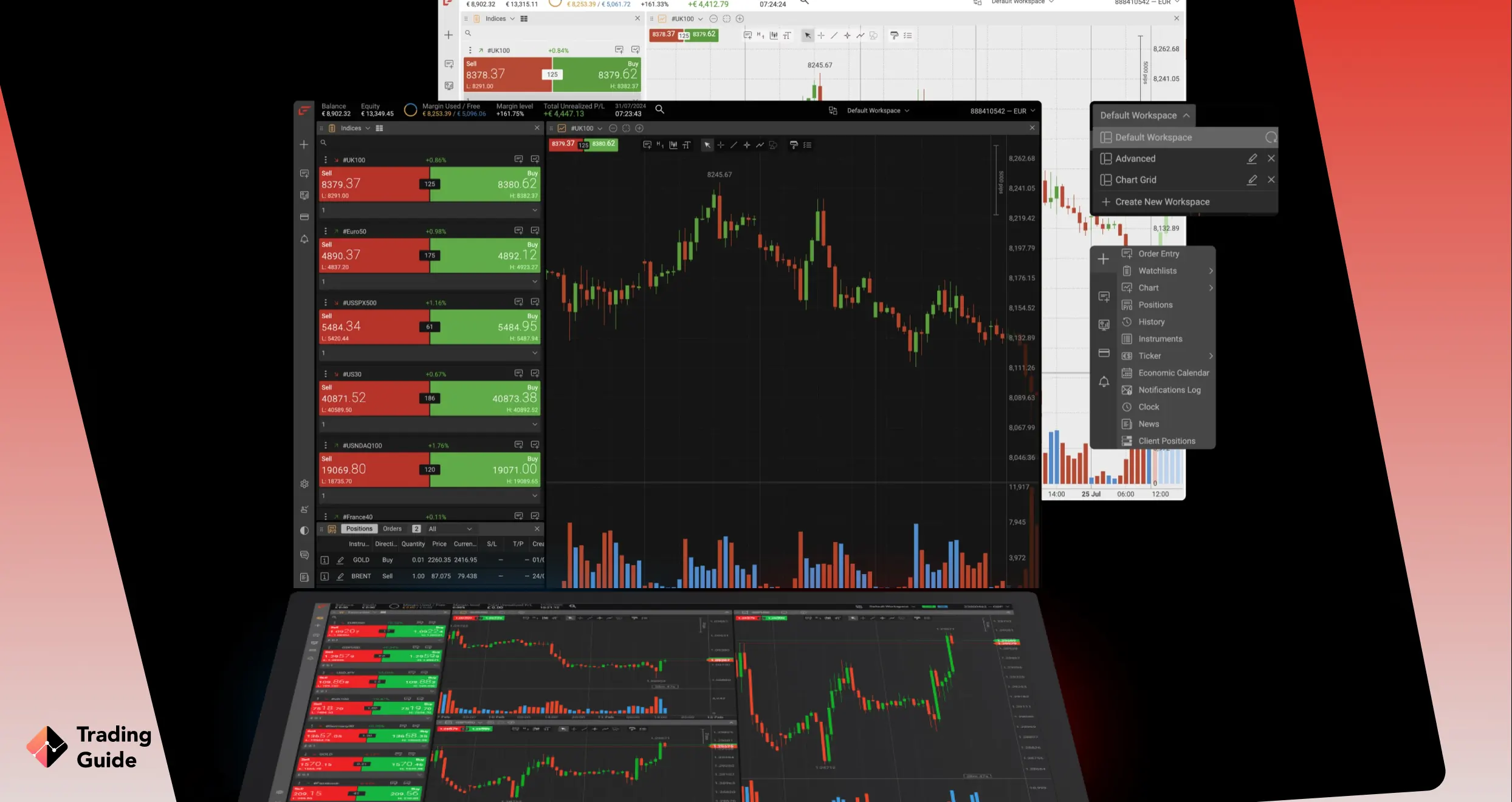

2. Plus500 – Top-Tier Trading and Investment App

*illustrative prices

We tested and compared hundreds of trading and investment apps, and Plus500 stood out as one of our top options. We discovered that the app features a Plus500 Invest platform, though it is not available for UK clients. The platform is available for users in selected countries like Finland, Spain, and more. As a UK investor, you can still explore financial instruments via its CFD platform, which we find user-friendly and has a modern design. Moreover, Plus500 is one of the most highly rated apps by users due to its efficiency. This element has helped many navigate the financial landscape with zero assistance using their iOS and Android mobile devices.

We discovered over 2,800 CFD trading instruments at Plus500 UK. These include forex, shares, commodities, indices, ETFs, and more. The best part is that CFD trading for UK clients is commission-free, and the spreads you incur are also low, starting from 0.0 pips. On top of that, we like the app’s unique trading tools, which suit all types of traders. Professional clients can also explore advanced resources on the Plus500 “Professional Trading” platform. This includes higher leverage limits that go up to 1:300.

- Hosts a virtually funded demo account for exploring CFD trading risk-free

- Quality learning materials and a reliable 24/7 support service

- Top-ranking broker app in both the App Store and Google Play

- Low minimum deposit requirement of £100 for UK clients

- No deposit and withdrawal fees

- Plus500 has a £10 monthly inactivity fee that kicks in after only three months of the account’s dormancy

- Only CFD trading is available for UK clients. No buying and taking ownership of an underlying asset

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

3. Capital.com – One of the Best With Excellent Support Service

Capital.com offers one of the best investment apps for exploring various financial instruments. It has excellent features, including a reliable support service. When we contacted the team, we were met with professionalism and relevant solutions that enhanced our trading experience. The knowledgeable client support staff is available 24/7 via phone, email, and live chat.

This user-friendly and customisable app executes trades seamlessly on Android and iOS mobile devices. Through the app, UK traders can explore over 5,000 CFD and spread betting assets, including forex, shares, indices, and commodities. The best part is that Capital.com offers a 1X account supporting CFD trading without leverage.

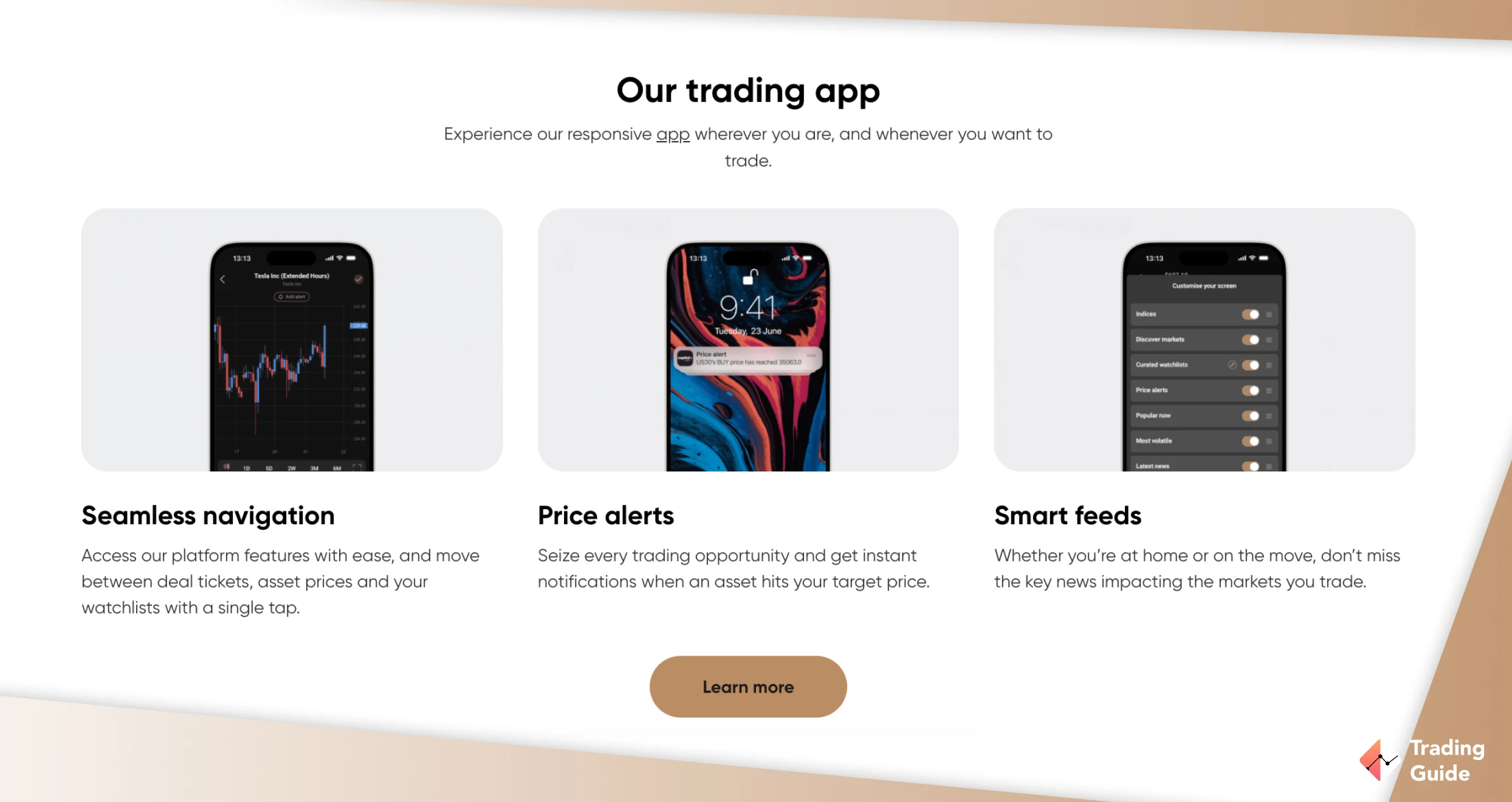

When it comes to platform accessibility, Capital.com hosts the MT4, TradingView, and its own Web version. The platforms guarantee quality trading resources, including smart feeds, price alerts, historical price charts, social trading, automated trading, smart trader tools, and more. An Investmate app is also available for download. It features high-quality learning materials that help traders familiarise themselves with the online trading landscape before risking their money.

- Low minimum deposit requirement of £20 for UK clients

- Free deposits and withdrawals

- Commission-free trades with low spreads from 0.0 pips

- Lists over 5,000 CFD and spread betting instruments

- Quality learning and market analysis tools across all featured platforms

- No physical purchasing of assets. Users only get to trade them as CFDs and spread betting

- No cryptocurrency trading for UK retail clients

| Type | Fee |

| Minimum Deposit | £20 |

| Commission/Spreads | Free commissions, with Capital.com spreads from 0.0006 pips |

| Overnight Funding | Yes, except for the 1X account |

| Currency Conversions | £0 |

| Guaranteed Stop-Loss Orders | Yes |

| Inactivity | £10 per month after 12 months of inactivity |

| Deposits and Withdrawals | £0 |

4. Pepperstone – One of the Cheapest Options

After testing and comparing hundreds of trading and investment apps in the UK, we found Pepperstone one of the cheapest options. Downloading and installing the app on our Android and iOS mobile devices was straightforward. Plus, we like that the app has no minimum deposit requirement and charges some of the lowest commissions and spreads. Based on our analysis, the app is suitable for low-budget and active traders. Newbies will also have an exciting experience, as it allows them to start trading with any amount they can afford.

Another element about Pepperstone that we find intriguing is its free learning resources. There are plenty of guides, articles, recorded videos, and webinars to help newbies advance their skills. Professional traders also have an opportunity to explore advanced resources on the MT4, MT5, cTrader, and TradingView platforms. While Pepperstone does not support physical purchasing and ownership of the assets, you can trade them as CFDs and spread betting.

- No minimum deposit requirement

- Free deposits and withdrawals

- Low trading fees, with spreads starting from 0.0 pips on major currency pairs

- Quality learning and market analysis tools

- Supports social and automated trading

- Limited asset offerings compared to its peers

- No buying and taking ownership of the listed assets

| Type | Fee |

| Minimum Deposit | $0 |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

| Inactivity fee | No |

| Account fee | No |

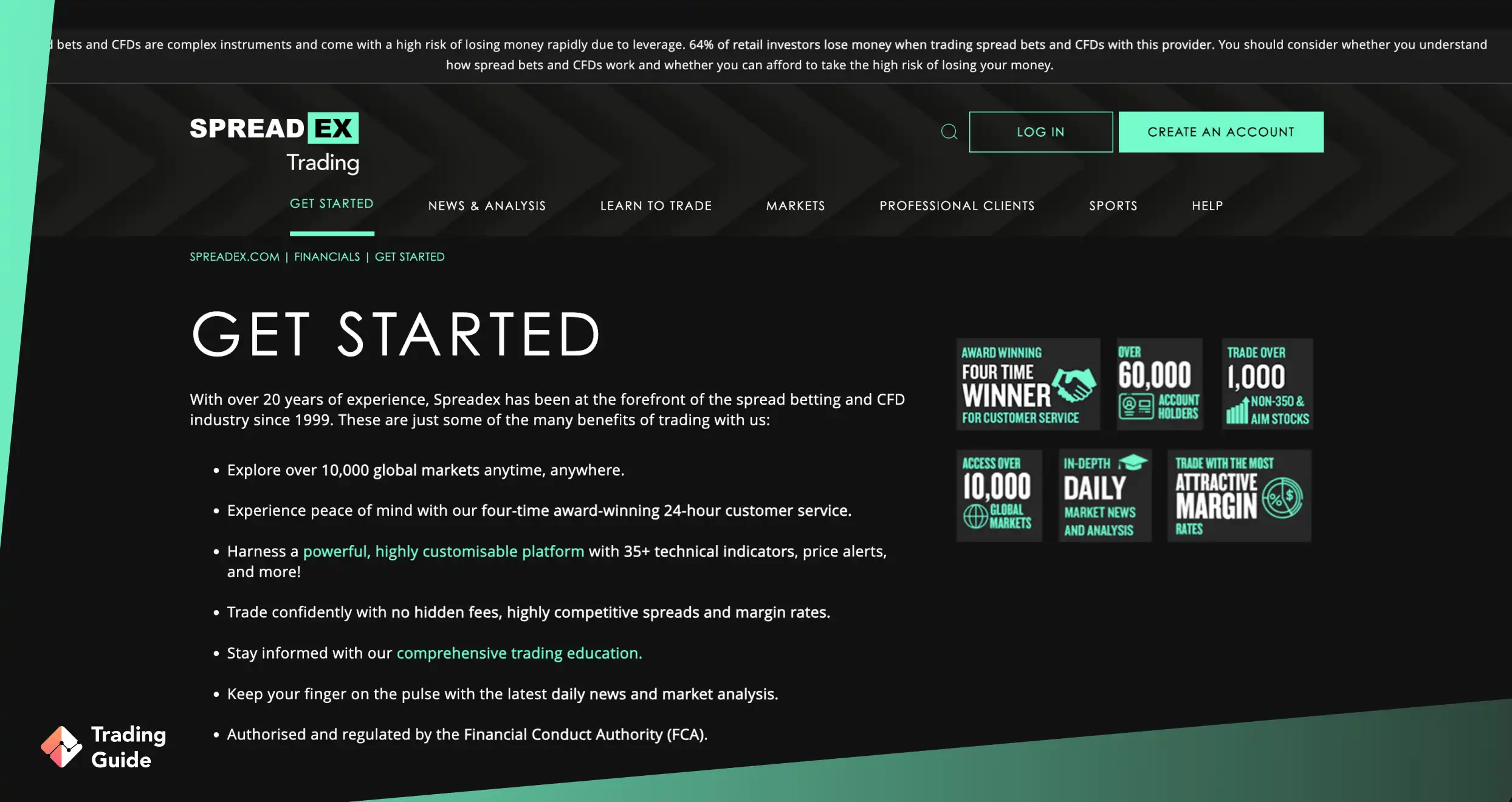

5. Spreadex – Best Trading App With Spread Betting Options

Upon testing Spreadex’s trading app with spread betting options, our experience was impressive. The app offers an intuitive interface that simplifies navigation and trade execution. We noticed its seamless integration with essential tools for market analysis, making it ideal for beginners and seasoned traders. Spreadex’s range of over 10,000 instruments for spread betting is comprehensive, covering shares, commodities, forex, indices, and more. The app’s accessibility and user-friendly design enhance the user trading experience. With competitive spreads and no minimum deposit requirements, Spreadex emerges as a top choice. We also liked the presence of the TradingView platform, which is suitable for professional traders looking for a more advanced experience.

- Over 10,000 tradable instruments, including shares, commodities, indices, and more

- There is no minimum deposit requirement, making it accessible to all traders

- User-friendly and customisable trading platform

- Competitive spreads, starting at 0.6 pips

- You can only trade the supported assets as CFDs or spread betting

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

6. FxPro – Best Trading App For MetaTrader Users in the UK

In our extensive exploration of trading and investment apps in the UK, FxPro stands out as the best for MetaTrader users, delivering an unparalleled user experience. With a user-friendly and customisable platform, FxPro caters to all user preferences, thus ensuring seamless navigation. The £100 minimum deposit requirement makes trading accessible, providing instant access to an impressive array of over 2,100 CFD assets, including forex, shares, indices, and more.

While testing this app, we had an amazing experience using our mobile devices. No wonder most Google Play and App Store users find it reliable. The MT4 and MT5 platforms didn’t disappoint us, and we enjoyed their advanced tools, including EAs, customisable charts, and more. Free deposits and withdrawals, along with fast order execution speed, enhance our trading efficiency, so feel free to test it via its demo account.

- FxPro’s platform is user-friendly and customisable.

- A minimum deposit requirement of £100 makes trading accessible to a broad range of users.

- The inclusion of both MT4 and MT5 caters to different trading preferences.

- Free deposits and withdrawals.

- Fast order execution speed.

- Limited asset offerings compared to its peers.

- Certain features, such as high leverage and crypto trades, are restricted to professional traders.

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

What Do Other Traders Say?

As a trader looking for a credible and reliable trading and investment app, you must test and compare different options. You also need to analyse user testimonials to learn about their real-time experiences and decide whether to stick with an app. We sampled some of the user testimonials on Google Play, the App Store, and Trustpilot. Below, we share a few to help you make a suitable choice.

Plus500

Traders highlight Plus500’s user-friendly interface and the ability to trade CFDs on ETFs as appealing features. However, some users mention the need for a broader range of ETFs on the platform.

-

“After many years of trading on this platform I had the chance to learn and improve my trading skills. It’s the best app and easy to use. I’ve tried other platforms but this one it’s far better ?” – Ludovic Gyorfi

-

“Very good, no problems with deposits or withdrawals, real time prices, you can make alot of money here.” – ramzyki

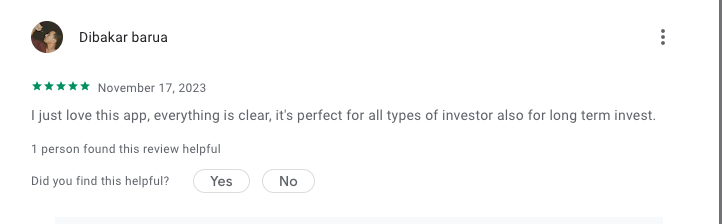

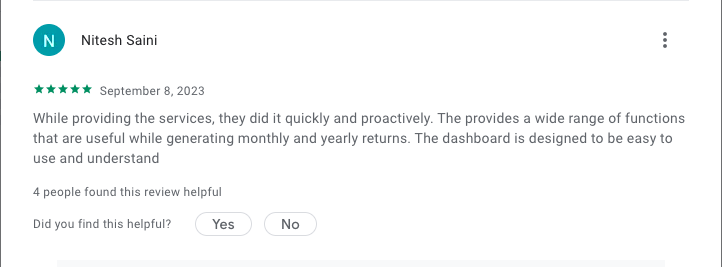

eToro

Users praise eToro’s diverse ETF offerings and the platform’s social trading features. Many appreciate the ease of navigating the platform and the ability to track and replicate successful traders’ portfolios, making it a compelling choice for ETF investments.

-

“I just love this app, everything is clear, it’s perfect for all types of investor also for long term invest.” – Dibakar Barua

-

“While providing the services, they did it quickly and proactively. The provides a wide range of functions that are useful while generating monthly and yearly returns. The dashboard is designed to be easy to use and understand” – Nitesh Saini

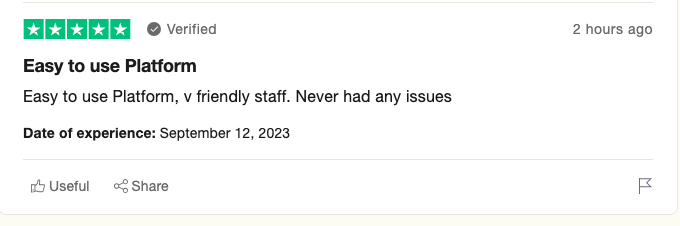

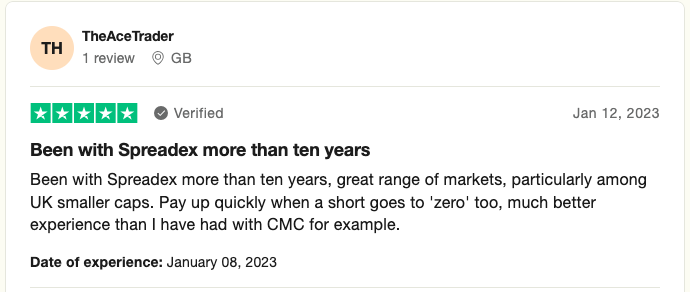

Spreadex

Users appreciate Spreadex’s diverse ETF portfolio and the platform’s intuitive interface, making it accessible for both beginners and seasoned traders. The competitive fees and responsive customer support have also garnered favourable reviews.

-

“Easy to use Platform, v friendly staff. Never had any issues” – Matthew Hill

-

“Been with Spreadex more than ten years, great range of markets, particularly among UK smaller caps. Pay up quickly when a short goes to ‘zero’ too, much better experience than I have had with CMC for example.” – TheAceTrader

FxPro

When it comes to FxPro, the majority of users praise its platform’s reliability and a variety of asset classes. Others mention the low fees and the professionalism of the customer support team, ensuring a positive trading experience.

-

“I just love this app, everything is clear, it’s perfect for all types of investor also for long term invest.” – Dibakar Barua

-

“While providing the services, they did it quickly and proactively. The provides a wide range of functions that are useful while generating monthly and yearly returns. The dashboard is designed to be easy to use and understand” – Nitesh Saini

The Ultimate Guide to Online Trading

Online trading has brought many benefits to individuals looking for ways to invest their money. If you want to venture into this field, start by understanding the asset you wish to trade and choosing a reliable platform or app to effectively manage your position and enjoy your experience. To help you get started, we have prepared the sections below to educate you on other elements regarding trading and investing in the UK.

What Are Investing Apps?

Investing apps are mobile applications or software that enable individuals to invest in various financial instruments directly from their smartphones or tablets. Just like their desktop versions, these apps offer user-friendly trading interfaces, real-time market data, and access to various investment options, including stocks, ETFs, forex, mutual funds, commodities, cryptos, and more. The apps also provide additional features like automated portfolio management, fractional share investing, social trading platforms, etc, to suit all types of investors.

Overall, investing apps UK have democratised investing, making it accessible and convenient for all types of traders. The apps empower users to take control of their financial futures, whether saving for retirement, building wealth, or exploring new investment opportunities. This is all done from the convenience of their mobile devices.

How to Choose the Right UK Trading or Investment App

As mentioned earlier, choosing the best UK trading or investment app guarantees your funds’ security and maximises your experience. If you are getting started with trading or investing in the UK’s financial space, here are the factors to consider when identifying the best app for trading.

The first thing you must do when looking for a suitable trading and investing app is to know its regulatory status. Therefore, consider an app licensed and regulated by the UK’s Financial Conduct Authority (FCA). Regulation not only signifies adherence to stringent standards but also offers protection through schemes like the Financial Services Compensation Scheme (FSCS). This ensures your investments are protected up to a specific limit in case of the app’s insolvency.

Assess the number and diversity of market assets available for trading or investment on the app. A comprehensive selection encompassing stocks, bonds, ETFs, commodities, and forex pairs allows for greater flexibility in crafting a well-rounded and diversified portfolio tailored to your investment objectives.

Analyse the availability of trading tools and features provided by the app you are considering. Look for real-time market data, advanced charting tools, technical indicators, and comprehensive research resources. These tools empower you to conduct a thorough analysis, make informed decisions, and execute trades precisely and confidently.

The best investment apps for beginners UK should be user-friendly with intuitive navigation to streamline your trading experience. That app’s trading platform should also have a fast trade execution speed and host quality learning resources for skills development. It is also crucial to settle for an app with a demo account, especially if it requires a high minimum deposit. This way, you can test it and gauge your skill level without risking your hard-earned money.

Pay close attention to the app’s fee structure, including commissions, spreads, and other associated charges. Compare fee schedules across different trading and investment apps to ensure they fit your budget without compromising the quality of services. Plus, confirm the non-trading charges such as minimum deposit requirement, transaction costs, inactivity fees, and more.

Seek authentic user testimonials and reviews from fellow investors with firsthand experience with the app. Honest feedback provides valuable insights into the platform’s reliability, performance, customer service, and overall user satisfaction, aiding you in making an informed decision.

Most traders overlook this element but it is as important as others we mentioned here. The best trading and investment app should have a very responsive customer support service. This makes it easier for you to contact them and be assured of relevant solutions to any arising concerns or challenges. The support team should also be accessible via multiple communication channels, including email, live chat, and phone.

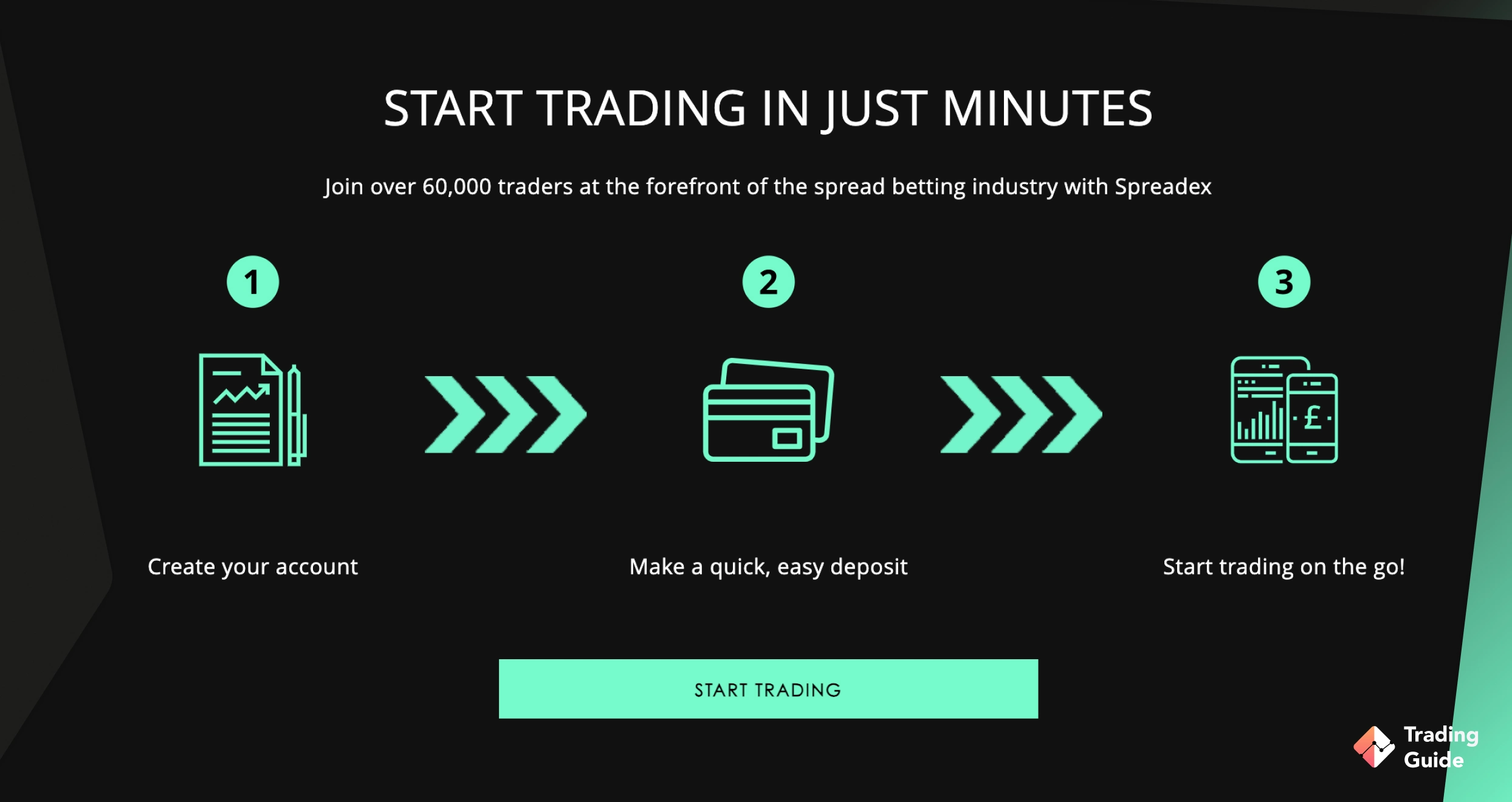

How To Register an Account with an Investment App

Registering an account with an investment app is easy and involves a few simple steps to start your investing journey. Here’s a concise guide on how to register an account with an investment app in the UK.

Begin by downloading the investment app of your choice from Google Play or the App Store onto your smartphone or tablet. The app should be reputable, with positive reviews and high ratings, to guarantee a secure and reliable investing experience. If you have limited time for research, consider our recommendations above.

Once the app is downloaded, open it and navigate to the registration or sign-up section. To create your account, provide the required information, such as your name, email address, and password. Some apps may require additional verification steps, such as phone number verification or email confirmation, to complete the registration process.

To comply with the FCA regulatory requirements, your app’s team may require you to verify your identity and location. This may include submitting copies of your national ID (passport or driver’s license) and a recent utility bill or bank statement. Follow the app’s instructions to complete the identity verification process accurately and promptly.

After verifying your identity, you will need to fund your investment account to start trading or investing. Depending on the app, you may have various funding options, such as bank transfer, debit/credit card, or electronic payment methods. Choose the preferred funding method and follow the instructions to securely deposit funds into your trading account.

With your account registered, verified, and funded, you are now ready to start investing. Explore the app’s platform and select your preferred asset to trade. You should also choose your position size and apply risk management controls such as stop-loss or take-profit orders to mitigate massive losses in case of a loss. Most importantly, consider portfolio diversification and keep track of your open activities to identify potentially profitable opportunities.

While you can sign up for a trading account using your mobile device, we advise you to consider using its desktop platform. This is because of the simplicity that comes with using a desktop. Once your account is fully verified and activated, you can transition to logging in to your mobile app.

Investing or Trading – What’s the Difference?

Investing involves buying assets for long-term growth, aiming for wealth accumulation through appreciation, dividends, and interest. It emphasises diversification and fundamental analysis, focusing on the intrinsic value of assets.

On the other hand, trading is all about short-term buying and selling to profit* from price fluctuations. Traders actively manage positions, relying on technical analysis and market trends to identify opportunities. They prioritise risk management and swift execution, aiming for quick profits within shorter time frames.

Ultimately, investing is about gradual wealth building, while trading seeks to capitalise on market volatility for immediate gains. Both approaches have distinct strategies and time horizons, thus catering to different traders’ financial goals.

*Don’t invest your money until you prepare to lose them.

Finding an App that Allows You To Both Trade and Invest

Finding an app that seamlessly combines both trading and investing functionalities offers the best of both worlds. Combining investments with trading provides a balanced approach to financial growth. For instance, while stock investments offer long-term stability, they may take months or even years to yield significant returns. In contrast, trading allows for daily profits through active buying and selling, offering immediate cash flow.

Overall, trading, particularly day trading, enables individuals to regularly generate income, either as a primary source or supplementary to traditional employment. However, trading requires swift decision-making and analysis of market movements, contrasting with the more patient approach of long-term investing.

As a trader looking to combine trading and investing, we advise you to find an app supporting both. From our recommendations above, we described perfect examples that provide both CFDs and stock investing. You simply have to confirm whether they suit your trading needs before making a commitment.

Why Invest in Stocks and Shares?

Investing in the stock and share market in the UK is a popular activity. Investors get into it hoping that the value of shares and stocks they purchase will appreciate, thus earning them profits. When you buy a company’s share, you become part of it. This means that you earn more profits as the company continues to grow and experience losses should it fail or go bust. The best element about investing in a growing company is that you supplement your profits with dividends (portion of the company’s annual profits*).

Stocks and share investing also come with flexibility. Unlike real estate, which can be illiquid and require substantial initial investment, stocks can be bought and sold relatively easily with lower entry barriers. Moreover, the stock market presents many investment opportunities, ranging from well-established blue-chip companies to smaller, high-growth startups. By carefully selecting a diverse range of stocks tailored to your investment objectives, you can construct a balanced investment portfolio poised for long-term growth and profit potential.

However, it’s essential to acknowledge the inherent risks associated with investing in stocks and shares. For instance, poor planning or market volatility can lead to the loss of investment capital. Therefore, ensure you conduct thorough market research and seek professional advice before making investment decisions. Most importantly, have a well-defined investment plan and partner with a reputable stockbroker to mitigate risks and maximise potential returns.

*Don’t invest your money until you prepare to lose them.

You can read about Best Crypto Apps in the UK and Best Crypto Brokers in 2026 in our other articles.

FAQs

Long-term investments involve opening and holding on to a position for a period exceeding one year. It’s the “traditional way” to make a profit from financial markets and is often just referred to as investments.

In many ways, long-term investments are the opposite of CFDs trading since CFD trading is speculative, ie. you’re speculating on whether the value of an instrument will increase or decrease over a short period of time.

We have written guides and recommendations for those of you looking to invest long-term and we suggest you take a look at our guides for more information.

You have a good chance of making good profits from investing long-term in high-volatility assets like stocks. Simply put, long-term investments mostly outperform the markets if you can keep your head cool and stick with your strategy.

Long-term investments are also good to use in combination with short-term trading strategies since it allows you to make use of more opportunities. This is why we never compare investments with trading to see what is “best”. Instead, we let you make that decision based on your needs and interests.

We can’t specifically say that the former is better than the latter and vice versa. However, long-term investment lets you hold on to a position for a more extended period, thereby increasing your chances of making more profits. In comparison, day trading involves opening and closing multiple positions daily. So, depending on your availability, choose what complements your needs.

The answer is both yes and no.

If you invest with a legally authorised broker like the ones we recommend above, then you do not need to worry about your investments’ safety. With that being said, all forms of investments and trading carry risks that you cannot completely avoid. That is investments will never be completely safe.

To keep safe while investing, you have to use a regulated broker and follow strict strategies for when to open and close your investments.

Note that since you will be risking your investments for a more extended period, it carries a high potential of returns over time.

Yes, Robinhood is a licensed and regulated broker, and therefore, it is safe for long-term investments. Being the fact that Robinhood is a rather new investment broker, it uses all the latest encryption and safety measures on the market, making it one of the safest options around.

Unfortunately, Robinhood is not currently available in the UK or the rest of Europe. This is because the broker only has licenses to offer their services in the United States.

In the U.S – where Robinhood is available – it is a broker suitable for the best long-term investments.

Conclusion

Nowadays, trading apps have become must-have tools in the financial space, considering the benefits they bring. As a trader or investor, note that there are numerous fraudulent providers in the UK’s financial space. Therefore, always follow our steps above in choosing a trading or investment app to avoid falling victim to fraudsters. You should also ensure your mobile device is highly secured with an added password to prevent unauthorised access to your trades. And when you start trading, remember that success doesn’t come easily. Be patient, disciplined, and open to learning from mistakes if you want to see progress in your activities.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

Can I day trade on IG Markets? Or is it only suitable for intraday trading and long-term investment?

Yes! but the cost of day trading depends on which markets you choose to trade and the market conditions. also of your personal circumstances and attitude to risk! With IG, you will need to fund your account by a minimum of £250 to start trading. I started from £500

The article is a short and helpful guide for people like me who've been into crypto for about a year. It nicely talks about the growing popularity of investment apps, showing how easy they make crypto trading, especially on your phone. It talks about important things like rules, types of assets, and tools for trading. This helps a lot when picking the best app. The article also explains the difference between investing and trading, and suggests apps that are good for both. As someone who likes crypto, this guide really helps me plan my investments better.

OANDA has proven to be a reliable choice for me. The platform is user-friendly, making it easy to navigate even for beginners. Buying and selling cryptocurrency is simple. OANDA offers a good selection of cryptocurrency options. Overall I have had a positive experience with OANDA.

Great article! From my experience, the importance of low fees and solid regulation can’t be overstated.