Trading options in the UK financial market can be both exhilarating and daunting, especially if you do not have the right platform in your corner. With numerous options trading platforms vying for your attention, finding the right one can feel like navigating a maze. But fear not! As seasoned TradingGuide experts, we understand the importance of starting on the right foot. That is why we have prepared this guide to not only unveil the best options trading platforms in the UK but also arm you with the knowledge and insights to confidently kickstart your ventures.

Essence

- The best options trading platforms in the UK provide diverse options contracts (calls, puts, spreads, etc.), catering to various trading strategies.

- Ensure the chosen platform aligns with all your trading needs for an engaging and comprehensive trading journey.

- Prioritise platforms regulated by reputable financial authorities to ensure compliance, security, and transparent trading operations.

- Integrated mobile apps enable traders to execute trades, monitor portfolios, and access critical data from anywhere, ensuring flexibility and convenience.

- Options trading involves complexities; grasp the risks and rewards before trading.

- Basic options strategies can aid novice investors in protecting their downside and hedging market risks effectively.

List of the Best Options Trading Platforms in the UK 2025

- Plus500 – Great Options CFD* Trading Platform for Mobile Traders**

- XTB – Cheapest Options Trading Platform in The UK

- IG – Top Platform for Options Spread Betting

- Spreadex – Best Options Trading Platform With No Minimum Deposit Requirement

- Saxo – Trading Platform with the Best Option Trading Tools

- Interactive Brokers – Best Options Trading Platform For Professional Investors

*76% of CFD retail accounts lose money

**Investment Trends 2022

How We Choose Options Trading Platforms

At TradingGuide, we are committed to providing you with the most reliable and insightful recommendations for options trading platforms in the UK. Our selection process is rigorous and comprehensive, ensuring that you have access to only the best options available.

We begin by conducting extensive research and rigorously testing each options trading platform. Our team of experts leaves no stone unturned, exploring every feature and functionality to assess its performance and usability.

We also compare the platforms based on our hands-on experience, categorising them according to their unique strengths and suitability for different traders. And to maintain objectivity and transparency, we incorporate user testimonials from Google Play, the App Store, and Trustpilot. By combining our findings with real user feedback, we provide you with a well-rounded perspective on each platform’s performance and user satisfaction.

Compare Options Trading Platforms in the UK

Now that you have the top options trading platforms in the UK, we thought it is best to present a comparison table below. This table serves as your ultimate reference point, offering a concise overview of key features and functionalities. With this handy tool, we hope you can easily identify an options trading platform that resonates most with your trading style and objectives.

| Options Platform | Licence | Support Service | Software | Payment | Demo Account | Money Insurance |

|---|---|---|---|---|---|---|

| Plus500 | FCA (FRN 509909), CySEC (#250/14), ASIC (#417727), MAS, FSA, SFSA, EFSA, DFSA, FSCA, FMA | 24/7 | Plus500 Webtrader, Mobile App, Plus500 Invest, Plus500 Futures | Bank Wire Transfer, Credit/Debit Cards, PayPal, Skrill, Google/Apple Pay | Yes | Yes (up to £85,000) |

| XTB | FCA, FSC, CySEC | 24/5 | xStation 5, xStation Mobile | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, PayPal | Yes | Yes (up to £85,000) |

| IG Markets | FCA, BaFin, DFSA, FSCA, MAS, ASIC, CySEC | 24/5 | Online platform, Trading apps, ProRealTime, MT4, L2 Dealer, TradingView, US options and futures | Credit/debit cards, bank transfer, PayPal | Yes | Yes (up to £85,000 by FSCS) |

| Spreadex | FCA | 24/5 | Spreadex’s Online Trading Platform, TradingView | Credit/Debit Cards, Bank Transfer, Neteller, Apple/Google Pay | No | Yes (up to £85,000) |

| Saxo | FCA, MAS, FSMA, ASIC, FSA | 24/5 | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO | Bank Transfers | Yes | Yes (up to EUR 100,000) |

| Interactive Brokers | FCM, CFTC, SEC, FINRA, MAS, ASIC, CBI, FCA, SFC (Hong Kong), IIROC/CIRO, NYSE (exchange member), NFA | 24/5 | IBKR Desktop, Trader Workstation (TWS), IBKR Mobile, IBKR GlobalTrader, Client Portal, IBKR APIs, IMPACT | Bank Wire Transfers, ACH Transfers | Yes | Yes (up to £85,000) |

Brief Overview of Our Recommended Options Trading Platforms’ Fees and Assets

Discovering the right options trading platform that aligns with your trading objectives is a crucial step toward achieving your financial ambitions. We have prepared the tables below highlighting essential insights into the fees and assets available across our recommended options trading platforms. Feel free to compare and analyse them to make informed decisions.

Fees

| Options Trading Platform | Fees | Minimum Deposit Requirement | Transaction | Inactivity |

|---|---|---|---|---|

| Plus500 | From 0.0 pips | $100 | Free | £10 monthly |

| XTB | From 0.1 pips | £0 | Free | £10 monthly |

| IG Markets | From 0.1 points | £0 | Free | £18 monthly |

| Spreadex | From 0.6 pips | £0 | Free | None |

| Saxo | From £0.02 commission | £0 (for Classic account) | Free | £0 |

| Interactive Brokers | From $0.01 commission on US stocks | £0 | Free | None |

Assets

| Best Options Trading Platform | Forex | Stocks | Commodities | ETFs | Options |

|---|---|---|---|---|---|

| Plus500 (CFDs) | Yes | Yes | Yes | Yes | Yes |

| XTB | Yes | Yes | Yes | Yes | Yes |

| IG Markets | Yes | Yes | Yes | Yes | Yes |

| Spreadex | Yes | Yes | Yes | Yes | Yes |

| Saxo | Yes | Yes | Yes | Yes | Yes |

| Interactive Brokers | Yes | Yes | Yes | Yes | Yes |

Our Opinion & Overview of the Best UK Options Trading Platforms

Having scrutinised the options trading UK landscape, we present our expert opinion and overview of the best options trading platforms available. Our recommendations stem from rigorous research and analysis, coupled with invaluable user feedback from Google Play, the App Store, and Trustpilot. We evaluate various factors, including fees, asset availability, trading tools, customer support, and more, to ensure you are in a better position to make the best choice.

1. Plus500 – Great Options CFD Trading Platform for Mobile Traders

*Illustrative prices

Among the options trading platforms we tested, Plus500 stood out as the best for mobile traders. This is primarily because we noticed many users on Google Play, the App Store, and Trustpilot highly review it. Moreover, our hands-on experience on Android and iOS mobile devices was exceptional. Its search function made navigation so streamlined, and the passwords and biometrics feature allowed us to secure our accounts from unauthorised access. You can get started with as little as £100 and enjoy commission-free trades.

Options trading at Plus500 is available as CFD, whereby you only speculate on the value of options securities. The best part is that retail clients are exposed to leverage trading with limits up to 1:5. We also discovered a “Professional Trading” platform specifically tailored for expert traders. The platform hosts unique advanced resources that guarantee an exciting experience. For beginners, Plus500 hosts adequate learning tools on its “Trading Academy” platform. There is also a demo account for testing it and gauging your skill level before making a commitment. Other securities hosted by Plus500 include forex, shares, cryptos, commodities, ETFs, and more.

*Investment Trends 2022

- A user-friendly and intuitive design platform with fast trade execution speed

- Commission-free options trading

- Free deposits and withdrawals

- Quality trading resources for both newbies and professional traders

- Only CFD assets offered

- Limited asset offerings compared to its peers.

| Type | Fee |

| Overnight Funding | yes |

| Currency Conversion Fee | 0.7% |

| Guaranteed Stop Order | spread applies |

| Inactivity Fee | $10 per month |

| Withdrawls/Deposits | $0 |

Note: 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. XTB – Cheapest Options Trading Platform in The UK

Options trading is becoming popular in the UK, and we like the fact that XTB allows its users to explore this market. With no minimum deposit requirement, any user can get started here with any amount they can afford. During our experience, we also discovered that the platform charges low fees for options trading and its inactivity fee kicks in after 12 months. When it comes to transaction charges, XTB supports free deposits and withdrawals. For these reasons, we believe it is a perfect options trading platform for budget-conscious users in the UK.

The best element about trading options with XTB is that you get an opportunity to earn interest on your uninvested funds while waiting for the perfect opportunity. For UK traders, the interest rate is 2.5% for funds less than £30,000 and 4.9% for amounts exceeding £30,000. Besides options, XTB lists an additional 5,500+ securities, including forex, shares, commodities, and more, for portfolio diversification.

- Commmission-free options trading

- No minimum deposit requirement

- Fast trade execution speed

- Great research materials

- Transactions using e-wallets attract a fee

- Support service availability can be improved

| Type | Fee |

| Opening an account | $0 |

| Account type: Standard: spread | 0.5 |

| Account type: Swap Free: spread | 0.7 |

| Forex | From 0.1 pips |

| Stock CFDs commission | 0% |

| ETF CFDs | 0% |

| Crypto commission | From 0.22% |

| Monthly Fee for maintaining an Account | Free of charge or up to 10 EUR |

| Withdrawal fee | $0 |

| Deposit fee | $0 |

3. IG – Top Platform for Options Spread Betting

For anyone looking to trade options via spread betting in the UK, IG offers a flexible and feature-rich platform. A key benefit is the zero spread on expiry for options trades, which applies to indices, forex, and share options, helping you save on costs if positions are held until their fixed expiry. You can go long or short, use guaranteed stops, and manage risk effectively.

Besides spread betting, you can trade options as CFDs. We also discovered an additional 17,000+ CFD and spread betting assets, which we believe can help you effectively diversify your portfolio. Long-term investors can access over 12,000 global shares and ETFs via GIA, ISA, and SIPP accounts.

This options trading platform supports multiple interfaces, including the web platform, mobile app, MT4, ProRealTime, L2 Dealer, and TradingView. They all come with unique features, such as automated trading, watchlists and customisable alerts, economic calendars, order types, and more. Note that IG requires no minimum deposit to trade options.

67% of retail investor accounts lose money when trading spread bets and CFDs with this provider

- Zero spread on expiry for options trades

- Opportunity to trade options on indices, shares, and forex

- Has amazing offers for clients such as cashback deals, flexible interest rates on uninvested money, etc

- No minimum deposit for UK clients

- Gives access to 17,000+ CFD and spread betting securities

- UK clients have no access to the MT5 platform

- Higher CFD fees compared to some of its peers

| Type | Fee |

| Minimum account | £0 |

| Opening an account | £0 |

| Overnight funding | yes (depends on market) |

| Withdrawal fee | £0 |

| Inactivity fee | £18 monthly after 24 consecutive months of inactivity |

| Advanced graphs (ProRealTime) | £30 per months |

4. Spreadex – Best Options Trading Platform With No Minimum Deposit Requirement

If you want to start your options trading venture with a small capital, consider platforms with no minimum deposit requirements. We find Spreadex the best in this category because of its user-friendly and customisable interface, which is perfect for any newbie. From our test findings, UK clients can explore options trading as CFDs and spread betting. Besides free deposits and withdrawals, options traders will incur commissions and spreads from 1 pts. An additional 10,000+ securities are also at your disposal for portfolio diversification. These include forex, shares, ETFs, indices, bonds, and more.

Spreadex has no demo account to test it with and gauge your skill level risk-free. From our experience, this shouldn’t be a determining factor, considering its zero minimum deposit requirement and low fees. Moreover, Spreadex is integrated with TradingView, a third-party platform with advanced resources that expert traders will find beneficial. Read full Spreadex review in our another guide.

- No minimum deposit requirement

- List multiple options and an additional 10,000+ securities for portfolio diversification

- A powerful trading platform with quality learning and market analysis tools

- Operates seamlessly on desktop and mobile devices

- No demo account

- Does not support the buying and taking ownership of the featured instruments

| Type | Fee |

| Minimum deposit | Free |

| Overnight fee | Yes |

| Deposit fee | Free |

| Withdrawal fee | Free |

| Inactivity fee | Free |

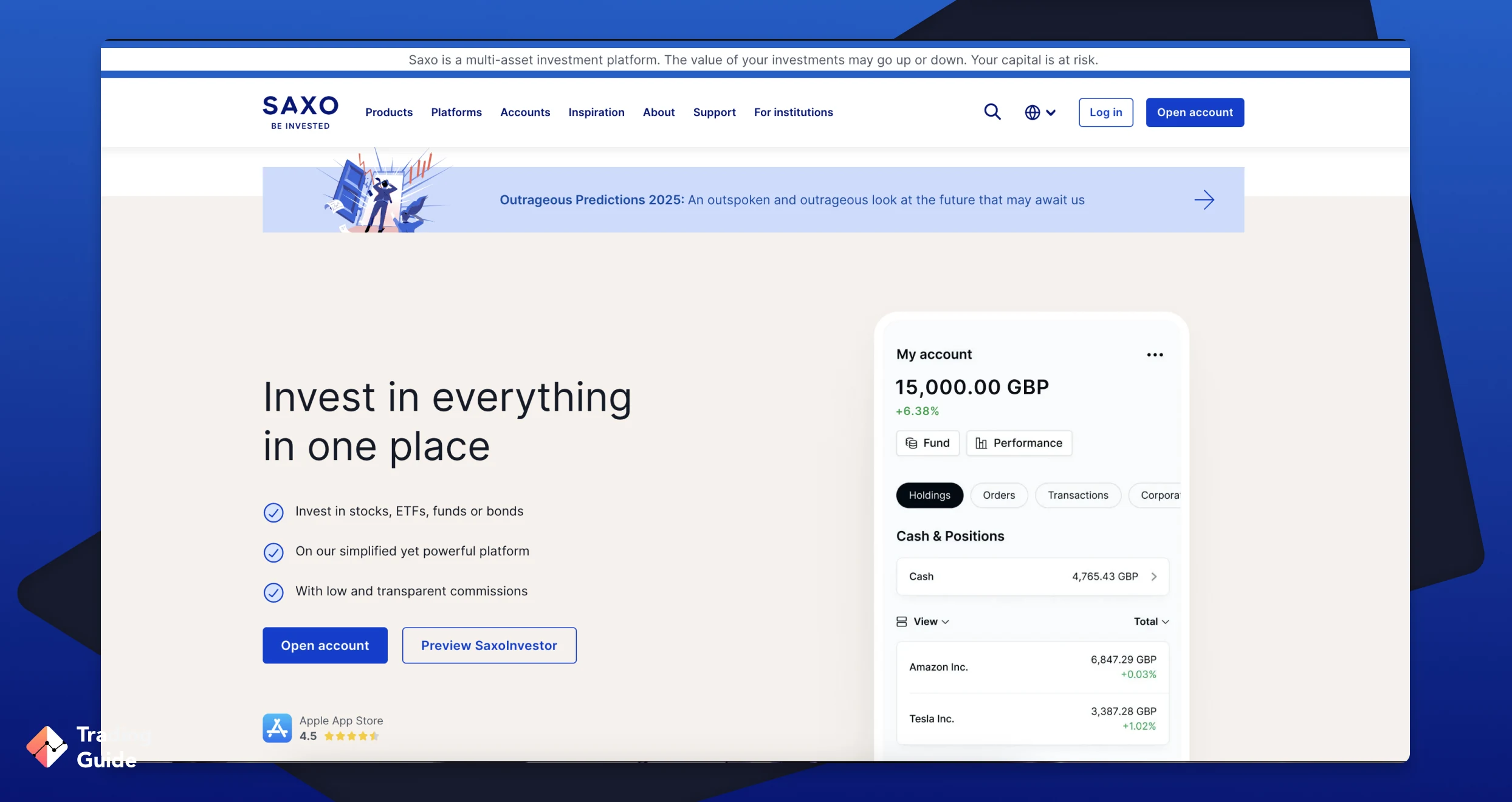

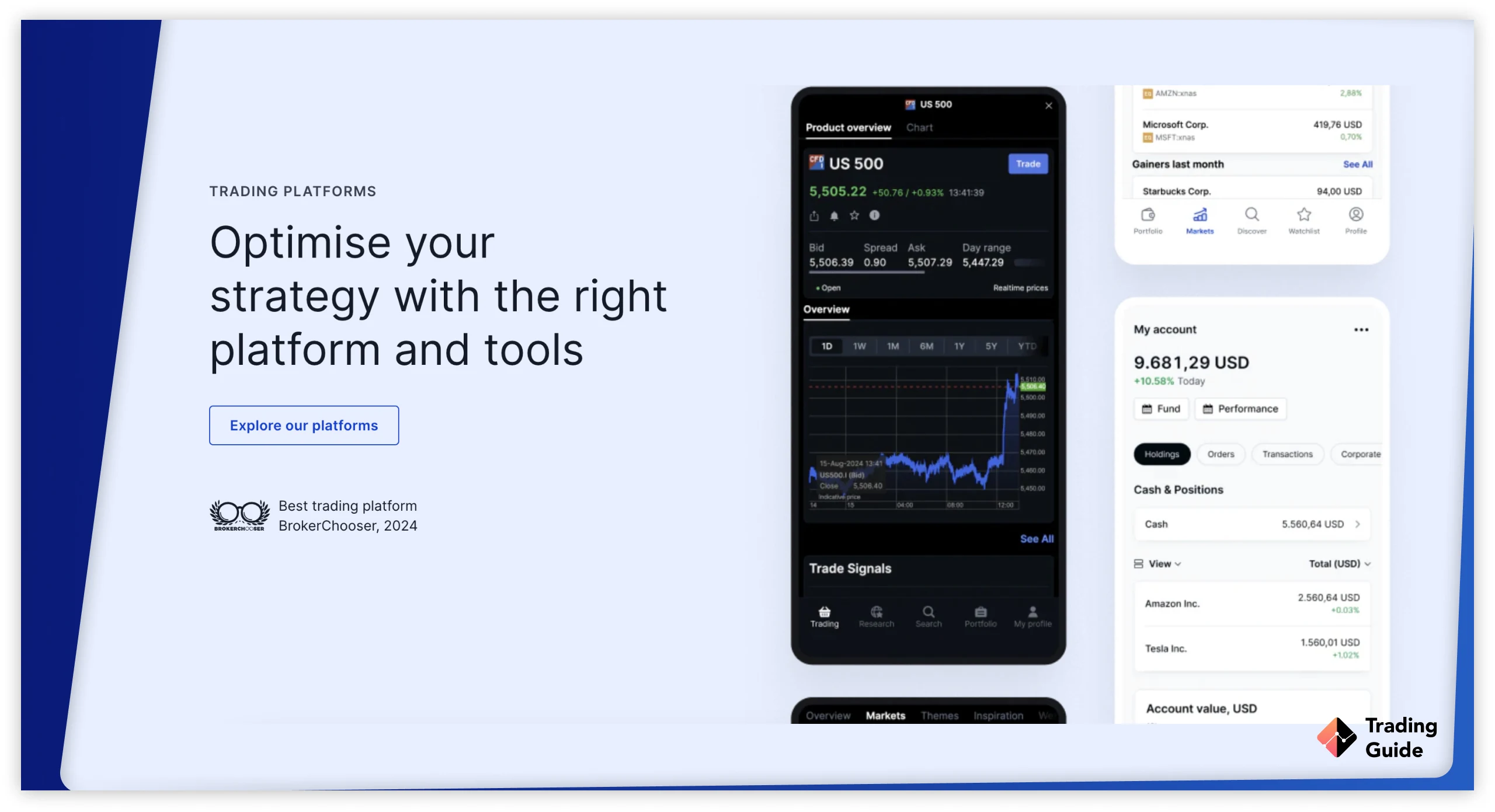

5. Saxo – Trading Platform with the Best Option Trading Tools

Saxo is one of the most highly reviewed options trading platforms, thanks to its cutting-edge technology and world-class trading tools. From our analysis and experience, we like that it has no minimum deposit requirement, thus attracting even low-budget traders. We also like that it supports options trading across multiple asset classes, including stocks, forex, indices, interest rates, shares, futures and commodities. Furthermore, options trading attracts low commissions starting from $0.75. When it comes to transaction charges, Saxo doesn’t impose any on you whether you make a deposit or withdrawal.

Saxo’s advanced trading tools are available on its SaxoTraderGo and SaxoTraderPro platforms. Additionally, we discovered other listed 71,000 instruments for efficient portfolio diversification. From our analysis, it’s a no-brainer that any user will enjoy trading options on this platform. Saxo hosts different accounts for all types of traders and a virtually funded demo account to test its performance.

- Low stock options trading fees

- No minimum deposit requirement

- Wide range of options trading tools

- Puts and calls on over 40 forex options

- No third-party platforms like the MT4/5

- Its support service availability can be improved

| Type | Fee |

| Minimum deposit | $0 (for Classic account) |

| Inactivity fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Manual order fee | €50 per order |

| Stocks | from $1 on US stocks |

| Futures | $1 per lot |

| Listed options | $0.75 per lot |

| ETFs | from $1 |

| Bonds | from 0.05% on govt. bonds |

| Mutual funds | $0 |

6. Interactive Brokers – Best Options Trading Platform For Professional Investors

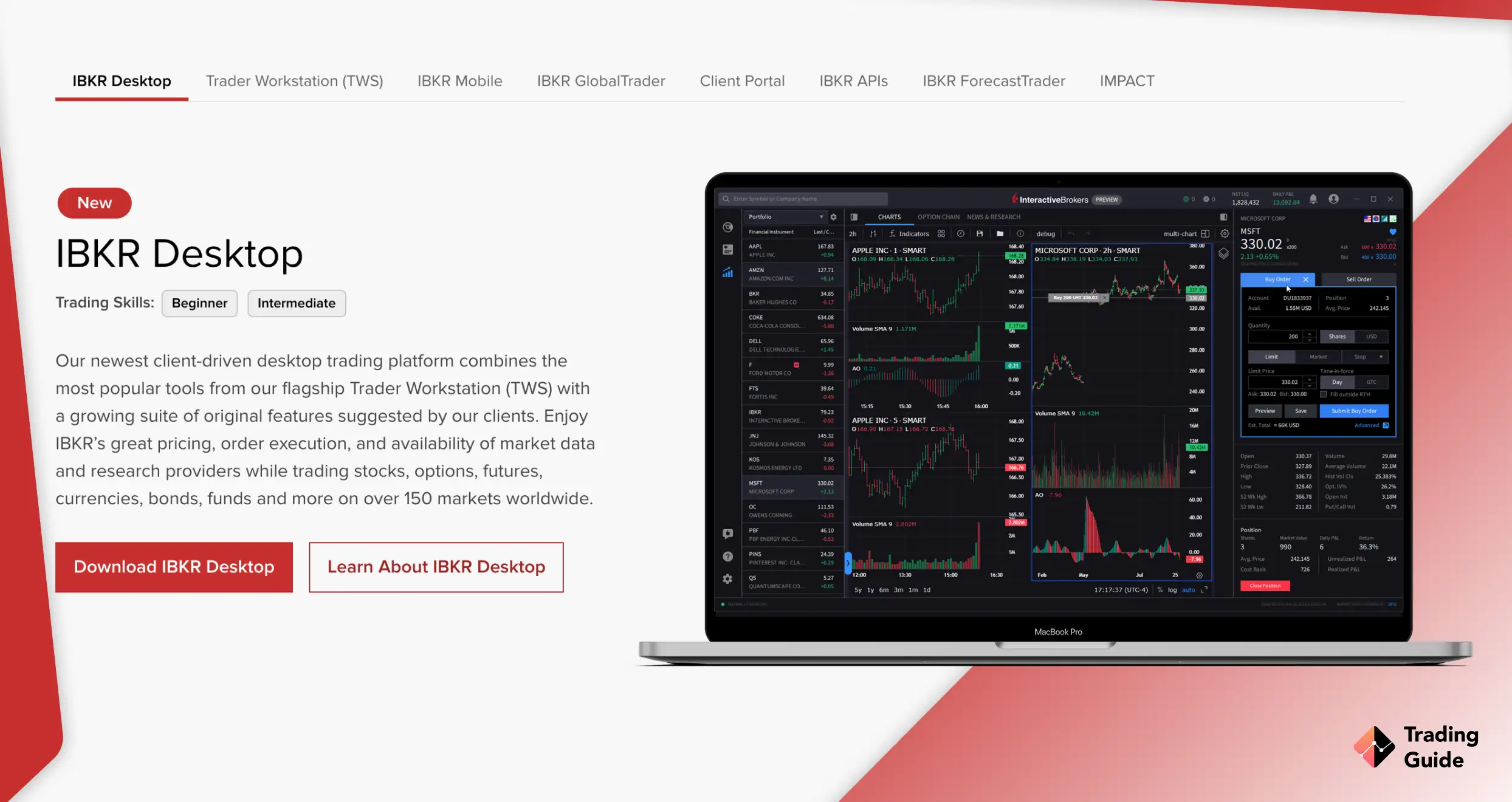

We extensively tested and explored Interactive Brokers (IBKR) for options trading, and the experience was nothing short of exceptional. The platform’s sophistication and tailored tools specifically designed for options trading were impressive. From advanced analytics to a plethora of options strategies, it caters perfectly to seasoned investors like us. The platform’s robustness, competitive pricing, and access to global markets provide a comprehensive and powerful trading environment.

Note that IBKR does not have a minimum deposit requirement, which we believe makes it easier for any user to get started. And although newbies may find its desktop platform challenging to navigate, the IBKR mobile app offers a seamless trading experience suitable for any beginner. With commissions from USD 0.15 to 0.65 per US option contract and access to 30+ global markets, we give it a 5-star rating.

- No minimum deposit requirement

- Low commission charges for options trading

- Quality learning and market analysis tools

- Access to 30+ market centres for options trading

- Support service response rate can be improved

- Charges high trading fees for most of its listed securities

| Type | Fee |

| Minimum Deposit | $10 |

| Deposit Fee | Free |

| Withdrawal Fee | Free |

| Inactivity Fee | $0 |

What Do Other Traders Say?

Understanding the experiences of fellow traders is essential when considering options trading platforms in the UK. Below, we present unfiltered user feedback from Google Play, the App Store, and Trustpilot for our recommended options trading platforms. Explore these candid insights to gain a comprehensive perspective and refine your choice based on real traders’ experiences.

Plus500

Users appreciate Plus500’s user-friendly platform for options trading and its range of tradable instruments. However, some users suggest improvements in educational resources specifically tailored to options trading strategies.

-

“After many years of trading on this platform I had the chance to learn and improve my trading skills. It’s the best app and easy to use. I’ve tried other platforms but this one it’s far better ?” – Ludovic Gyorfi

-

“Very good, no problems with deposits or withdrawals, real time prices, you can make alot of money here.” – ramzyki

-

“What made me happy and relieved in my trading life with plus500 is the withdrawals they so quick it literally never took me more than 6 minutes it was approved. Well guys hope south Africa uses your great platform ??” – Sifiso Lucky Biyela

XTB

Traders admire XTB’s comprehensive CFD trading tools and educational resources. The platform’s analytical tools and customer support are highlighted as beneficial for CFD trading.

-

“I have shares in other brokers, but I’m using this app to check prices and charts because it’s simply better. Flawless usability” – Kosciej

-

“Very good app. Customer service is welcoming. Lots of information for new traders available for free. Feel very valued and accepted as a beginner. Best app I have found after trying 10+ others.” – Thomas Ashley

Spreadex

Spreadex stands out for its straightforward options trading interface and diverse range of available markets. Users value the platform’s accessibility, yet some mention the need for additional educational resources.

-

“Easy to use Platform, v friendly staff. Never had any issues” – Matthew Hill

-

“Been with Spreadex more than ten years, great range of markets, particularly among UK smaller caps. Pay up quickly when a short goes to ‘zero’ too, much better experience than I have had with CMC for example.” – TheAceTrader

-

“A very useful financial spread betting app that should cover all your needs. It’s definitely the most useable of the broker apps that I’ve tried. A great platform that lets you analyse the markets, place spread bets & manage your risk and positions all on your phone. They’ve also got a great range of tools and excellent customer service which I found very attractive. 10/10 for my experience with Spreadex thus far” – JakeReadman

Saxo

Saxo receives praise for its extensive options trading features and analysis tools. Users highlight the platform’s versatility in catering to both novice and experienced options traders.

-

“The person was very patient and good at slowly explaining things step by step and also strived to introduce the useful functions of the trading platform.” – Frank Sakda Sreesangkom

-

“Took a bit to get used to, but now I can really appreciate the slick UI and great performance. Wide range of products and their support replied in a timely manner the few times I had questions. Also never had any problems with outages which is a huge relieve” – Christoph Müller

-

“This app is fast and efficient. It has good information about all the assets you can trade and nice articles about each type of asset.” – Anders Sch

Interactive Brokers

Users appreciate Interactive Brokers’ advanced options trading capabilities and vast range of available markets. The platform’s competitive pricing and sophisticated tools appeal to experienced options traders.

-

“Very good app, I’m using it on regilar basis. There is no such slow login issues for me, login lasts few seconds. Also the login is remembered when using biometric for some days/weeks, so you would need to enter passwords again, which is good security level.” – Vasil Popov

-

“IBKR’s iPhone app is far better for trading and for checking portfolio, browsing options prices, and looking at the market with watch lists, than Robinhood’s or Fidelity’s. They’re what I use for watchlists and to peruse options prices, even if I’ll end up trading on other brokers’ phone apps. It’s miles better. As for the broker, IBKR Pro has easily paid for itself and migrating to it has been objectively profitable for me. This is because of its better access to markets and trading hours allowing me to place certain trades. I’ve also been happy enough with trade execution and commissions costs.” – User4658991

-

“Best broker in the business – I’ve been with them 20 years. Lowest margins, best product range and fast execution.” – John

The Ultimate Guide About Options Trading

When considering futures and options trading, it’s imperative to understand that these markets are inherently highly leveraged and speculative. To navigate them successfully and mitigate risks, it’s crucial to familiarise yourself with the intricate contract terms and the potential for margin calls that could affect your positions.

These financial instruments demand a deep understanding of derivatives trading, and therefore, it’s advisable to engage in futures and options only if you possess the requisite knowledge and expertise. Prudent and informed participation in these markets is essential to safeguard your investments and capitalise on their potential benefits.

While choosing the best UK options trading platform marks the initial step in your trading journey, there’s a whole universe of knowledge awaiting exploration beyond this starting point. In the following sections, we explore every element of options trading, ensuring you’re armed with the insights and expertise needed to confidently navigate this thrilling market.

From laying the groundwork for your trading endeavours to selecting the optimal broker and understanding the intricacies of popular indices, we’ve got you covered. We will also guide you in identifying the easiest brokers to trade options with, ensuring a seamless and rewarding trading experience.

What is Options Trading?

Options trading is a versatile financial strategy where traders buy contracts, giving them the right (but not the obligation) to buy or sell financial assets at a set price within a specific timeframe. This approach offers the potential for high returns with less upfront capital and allows for hedging against market volatility. However, you should also note that options trading comes with risks, including potential loss of the entire investment. That is why we advise our readers to conduct extensive market analysis for solid strategies before trading options.

Types of Options

If you are looking to trade options in the UK. In this case, you must understand the different types of options available in the region. This way, you can make the best choices based on your trading strategy. Here are some of the top options to know.

Call vs Put Options

These are common among UK traders. In call options, a trader or investor buys a contract that allows them to purchase a specific asset at a set price within a specified timeframe. In contrast, put options enable the holder of an option to sell an asset within a particular date in the future.

The best element about the call and put options is that you maximise your chances of higher returns with little capital. Plus, it is one of the most flexible trading methods, allowing for hedging against market volatility.

European vs American Options

As a new options trader, you might believe that American and European options are specifically tailored for individuals in those regions. Fortunately, the names mean nothing and they are used to describe different options exercise.

Note that all options have expiry dates. In the end, you will either earn profits from the contract or let it expire worthless. In European options, traders can only exercise the contract on the expiry day. On the other hand, American options are more flexible, and you can exercise them at any time within the contract period.

Whether you choose to trade European or American options, always understand the risks involved.

Covered vs Uncovered Options

There are also covered and uncovered options, which are other ways of selling call and put options. With a covered call option, you can sell to a fellow trader the right to buy an already owned asset. Since you own the asset, you will hold a “long position.” Therefore, if the buyer wishes to exercise a call option, you will hand over your stock. Even though the stock will be below the market value, it limits the expected overall loss to be incurred.

When it comes to uncovered or naked call options, holders do not own the assets on which they are selling the options. The potential downside is unlimited since the stock will be purchased on an open market. It doesn’t matter what price a trader pays since they are fulfilling their obligation of the call option.

A covered put is almost similar to a covered call. The only difference is that the seller of the covered put already owns a ‘short’ position in the asset.

What is the Options Trading Example?

See an example below which explains in detail what options trading is all about.

Imagine you are interested in purchasing shares of a company, but you are unsure about its future performance. Instead of buying the stock outright, you decide to explore options trading.

You could purchase a call option contract for the stock. This contract gives you the right to buy a specified number of shares (let’s say 100) at a predetermined price (the strike price) within a specified timeframe (the expiration date).

For instance, suppose the current stock price is £50 per share, and you purchase a call option with a strike price of £55 per share expiring in one month. If, by the expiration date, the stock price rises above £55, you can exercise your option and buy the shares at the lower strike price of £55, potentially profiting from the price difference.

On the other hand, if the stock price remains below £55 by the expiration date, you are not obligated to exercise the option. In this case, you may choose to let the option expire worthless, limiting your losses to the premium paid for the option contract.

Read about Best Automated Trading Platforms and the Best Micro Account Brokers UK in our other guide.

How to Choose the Best Options Trading Platform UK

When selecting the best options trading platform UK, it’s essential to consider several key factors to ensure a seamless and satisfying trading experience. Here are some tips to keep in mind.

The first thing to look for when choosing an options trading platform UK is its regulatory status and safety measures. Ensure the platform is licensed and regulated by the Financial Conduct Authority (FCA) in the UK. Regulation provides assurance that the platform operates in accordance with established standards, offering a level of security and protection for traders’ funds. Plus, the best platform should be highly encrypted to secure your trading account from unauthorised access.

Look for a UK options trading platform that offers fast and reliable execution of trades, as well as a comprehensive suite of trading tools and features. These tools may include advanced charting capabilities, technical analysis indicators, risk management tools, and educational resources. A user-friendly interface and intuitive navigation are also essential for a seamless trading experience. For traders who are always on the move, ensure the platform you select has a trading app for a seamless mobile trading experience.

Understand the fee structure of the platform, including commissions, spreads, and any other trading fees. Transparency in fee disclosures is crucial, allowing traders to accurately assess the cost of trading and avoid unexpected charges. Compare fee structures across different platforms to ensure competitive pricing.

Evaluate the range of assets available for trading on the platform. This includes options contracts on various underlying assets such as stocks, indices, currencies, and commodities. A diverse selection of assets provides traders with more opportunities for diversification and exposure to different market sectors.

Assess the quality and responsiveness of the platform’s customer service. Look for platforms that offer multiple channels of support, including phone, email, live chat, and comprehensive FAQs. Prompt and helpful customer support is essential for resolving issues, answering queries, and providing assistance when needed.

Research user feedback and reviews to gauge the platform’s reliability, performance, and user satisfaction. Online forums, social media platforms, and independent review websites can provide valuable insights into the experiences of other traders. Pay attention to both positive and negative feedback to get a balanced perspective on the platform’s strengths and weaknesses.

Find out more about the penny stocks brokers in the UK in our other article.

Options Trading Risk Management

Options trading offers significant profit potential, but it also carries inherent risks. Effective risk management is essential for protecting your capital and maximising long-term success. Here’s how to manage risks in options trading.

- Position Sizing – Determine the appropriate size for each option trade based on your risk tolerance and account size. Avoid over-leveraging by limiting the size of each position to a percentage of your total capital, typically between 1% to 5%.

- Diversification – Spread your investments across different assets, industries, and strategies to reduce the impact of any single trade or market event on your overall portfolio. Diversification helps mitigate the risk of significant losses in case of adverse market conditions.

- Stop-Loss Orders – Set stop-loss orders to automatically exit trades if they move against you beyond a predetermined threshold. This helps limit potential losses and prevents emotions from clouding your judgment during volatile market conditions.

- Hedging Strategies – Use hedging strategies, such as buying protective puts or selling covered calls, to offset potential losses in your options positions. Hedging allows you to protect your portfolio against adverse price movements while still maintaining exposure to potential upside.

- Risk-reward Ratio – Evaluate the risk-reward ratio of each trade before entering into it. Aim for trades with a favourable risk-reward ratio, where the potential reward outweighs the potential risk. Avoid trades with poor risk-reward profiles that expose you to excessive downside risk for limited upside potential.

- Continuous Monitoring – Regularly monitor your options positions and the overall market environment. Stay informed about relevant news, economic indicators, and market trends that could impact your trades. Be prepared to adjust your positions or exit trades if market conditions change unexpectedly.

Option Trading Fees

Option trading fees are the costs you pay when you buy or sell options contracts. Note that these fees can differ depending on which broker you use. So, it’s a good idea to pick the best option trading platform UK that fits your budget. Lets break down below the different types of option contract fees and how they might affect how much you spend on trading.

- Commission – Many brokers charge a commission for executing options trades. This fee is typically charged on a per-contract basis, meaning you’ll pay a fixed amount for each options contract you buy or sell. Commission rates can vary widely among brokers, so it’s important to compare fees to find a broker with competitive pricing.

- Contract Fees – In addition to commissions, some brokers may charge a fee per options contract traded. This fee is typically small, but it can add up, especially if you’re trading a large number of contracts. Be sure to factor in contract fees when assessing the overall cost of your options trades.

- Assignment and Exercise Fees – If you choose to exercise an options contract or if you’re assigned an exercise notice, your broker may charge a fee. Exercise fees are usually assessed per contract and can vary depending on the broker. Similarly, assignment fees may apply if you’re assigned an exercise notice on a short options position.

- Exchange Fees – Options trades executed on exchanges may be subject to exchange fees. These fees are charged by the exchange and are typically passed on to the trader by the broker. Exchange fees can vary depending on factors such as the exchange and the volume of trades.

- Spread Costs – When trading options, you’ll often encounter bid-ask spreads – the difference between the price at which you can buy an option (the ask price) and the price at which you can sell it (the bid price). This spread represents a cost to the trader and can impact your overall trading profitability.

- Margin Interest – If you trade options on margin – meaning you borrow funds from your broker to finance your trades – you may be charged margin interest on the borrowed funds. Margin interest rates vary depending on factors such as the amount borrowed and prevailing interest rates.

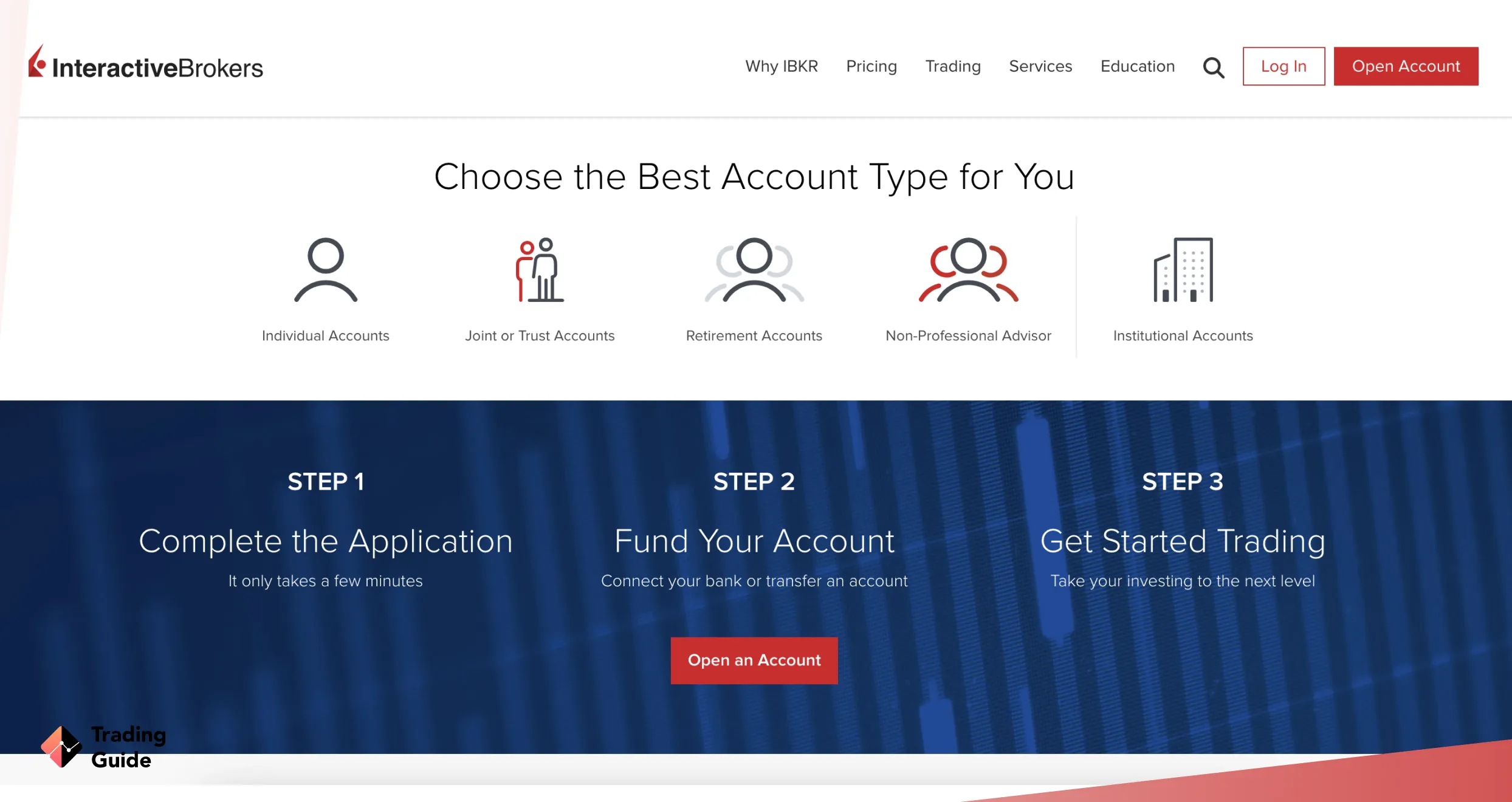

How to Register a Broker Account to Trade Options

Kickstarting your options trading journey can be an exciting endeavour, especially if you have the best broker like the ones we recommend above. If you are a beginner, let’s walk you through the process below.

Begin by researching and selecting a reputable broker that offers options trading services. Above, we recommend some of the top options regulated by the FCA and feature excellent services. You should also install the broker’s trading app on your mobile device and understand its terms and conditions before visiting its website to start the account registration procedure.

Once you have chosen a broker, visit its website and locate the “Open Account” or “Sign Up” button. Follow the prompts to provide your personal information, including your name, address, email, phone number, and more. Some brokers will also require you to create a username and strong password for an added layer of security. Ensure you provide accurate information since you will verify those details in the following step.

To comply with the FCA regulatory requirements, brokers typically require verification of your identity. This may involve uploading a copy of your government-issued ID, such as a passport or driver’s license, and providing proof of address, such as a utility bill or bank statement. For most brokers, the verification step may take up to 48 hours after which an email notification will be sent.

After your account is successfully registered and verified, you will need to fund it with an initial deposit. Note that the minimum deposit amount varies depending on the broker and account type. Therefore, settle with a broker you can afford and supports multiple payment methods, including bank transfer, credit/debit card, or e-wallets.

Once your account is funded, you are ready to start trading options! Explore the broker’s trading platform, familiarise yourself with the available options contracts, and begin placing trades based on your trading strategy and market analysis.

Remember, while you can earn profits trading options, losses are inevitable. Therefore, start by familiarising yourself with how options trading works using a broker’s demo account before investing real money. Plus, do not forget to conduct a thorough market analysis for solid strategies that can maximise your profit potential.

Assets to Trade Options

If you are looking to invest in the options market, there are numerous assets to trade options. We list below the most popular ones to choose from. However, ensure you are familiar with the asset you trade on options for maximum potential.

- Stocks: Options on individual stocks are the most popular form of options trading. This allows traders to buy or sell the right, but not the obligation, to buy or sell a specific stock at a specific price at a specific time.

- Indices: You can also trade options on stock market indices, such as the FTSE 100. With this options type, you gain exposure to the overall performance of the stock market rather than just an individual stock.

- Commodities: Options on commodities, such as gold, oil, and agricultural products, are also popular among traders looking to speculate on the price movements of these underlying assets.

- Currencies: There are also options for currencies, such as the U.S. dollar and the euro. It is a perfect options trading type for traders looking to speculate on the relative strength of different currencies.

- Bonds: Some traders invest in bond options, though they are less common than options on other types of assets. This allows traders to speculate on the price movements of the bonds, which can be affected by interest rates and credit risk.

Options Strategies to Know

Unlocking the potential of options trading involves employing effective strategies tailored to your objectives. Here are the top 10 strategies to streamline your options trading activities.

- Covered Call: This strategy involves selling a call option against a stock you already own. It generates income from the premium received while potentially limiting upside profit if the stock price rises above the strike price.

- Married Put: In a married put strategy, you buy a put option to protect a long stock position from potential downside risk. It provides insurance against a drop in the stock price while allowing you to participate in any upward movement.

- Bull Call Spread: A bull call spread involves buying a call option while simultaneously selling another call option with a higher strike price. This strategy profits from a moderate increase in the underlying stock’s price, with limited risk and potential profit.

- Bear Put Spread: The bear put spread entails buying a put option while simultaneously selling another put option with a lower strike price. It profits from a decline in the underlying stock’s price, with limited risk and potential profit.

- Protective Collar: This strategy involves buying a put option to protect a long stock position while simultaneously selling a call option to generate income. It provides downside protection while capping potential gains.

- Long Straddle: In a long straddle, you simultaneously buy a call option and a put option with the same strike price and expiration date. This strategy profits from significant price movement in either direction, regardless of the underlying stock’s direction.

- Long Strangle: Similar to a long straddle, a long strangle involves buying a call option and a put option with different strike prices but the same expiration date. It profits from significant price movement but with lower upfront costs compared to a straddle.

- Long Call Butterfly: This strategy combines a long call spread and a short call spread to profit from a narrow range of price movements. It involves buying one call option, selling two call options with a higher strike price, and buying one call option with an even higher strike price.

- Iron Condor: An iron condor involves simultaneously selling an out-of-the-money call spread and an out-of-the-money put spread. It profits from low volatility and range-bound price movement.

- Iron Butterfly: Similar to an iron condor, an iron butterfly involves selling an at-the-money call spread and an at-the-money put spread. It profits from low volatility and minimal price movement.

What Causes Options to Rise or Fall in Price?

Understanding why options prices fluctuate is essential for successful trading. Here’s a closer look at what drives these price movements.

- Underlying Price & Strike Price – The relationship between the underlying asset’s price and the strike price of the option is fundamental. For call options, if the underlying asset’s price is higher than the strike price, the option is “in-the-money” and tends to rise in price. Conversely, for put options, if the underlying asset’s price is lower than the strike price, the option is “in-the-money” and tends to rise in price.

- Time to Expiration – Options have a limited lifespan, and their value decreases as they approach expiration. This is known as time decay or theta decay. As time passes, the likelihood of the option reaching or exceeding its strike price diminishes, causing the option’s price to fall.

- Interest Rates – Changes in interest rates can affect options prices. Higher interest rates generally lead to higher options prices, as the opportunity cost of holding the option increases. Conversely, lower interest rates may result in lower options prices.

- Volatility – Volatility, or the degree of price fluctuation in the underlying asset, has a significant impact on options prices. Higher volatility generally leads to higher options prices, as there is a greater likelihood of the option reaching its strike price before expiration. Conversely, lower volatility results in lower options prices.

FAQs

Many options trading brokers in the UK, including the referenced ones above, will allow you to practice options trading on their demo accounts for free. In addition, every top-tier broker in the UK provides educational material ranging from simple text guides to videos and even live webinars.

Moreover, we have created a long list of guides for all our readers and we cover the topic of options trading in detail.

Lastly, the more traditional ways of learning how to trade options are to read books on the topic and to learn from and get inspired by other more successful investors and traders.

Yes, options trading in the UK is legal and fully regulated. In fact, due to current regulations, you can only trade options (and other instruments) with an FCA accredited broker, ie. a broker that has been licensed and approved by the FCA.

The reason for this is that brokers are financial institutions that fall under the same strict legal framework as banks. And naturally, all of this is required to keep you as a trader and/or investor safe.

You see, regulated brokers are obligated to keep you and your funds safe and protected at all costs. This means separating invested funds from company funds, providing accurate prices, and executing trades promptly.

Absolutely – you can trade with as much or as little as you can afford. There are brokers in the UK with a minimum deposit of $100 or less, meaning that it is possible to get started with $100.

After you’ve made your first initial deposit of $100 or less, you can control all your deposits even further, thus depositing even less than $100 to continue trading in the future.

Options and stock trading are both risky but profitable investments if you apply the right strategies. At the same time, options and stock trading can also be risky and there is never a guarantee that you’ll make a profit.

Therefore, it all depends on a trader’s needs and how familiar they are with how options trading works. In fact, we would never compare two types of trading to figure out “which one is the better” since it all depends on you as a trader, your interests, and your needs.

No, you do not need a margin account to trade options since most traders use cash accounts. When using a margin account you can apply margin and leverage to increase the exposure to every position you open.

However, the use of margin and leverage also increases the risks when trading. Therefore, we advise you to use margin accounts with great care.

Yes, of course, you can! In the same way that you can make profits, you can lose money if you do not apply the right strategy. This is the same for all types of trading and investment and does not only apply to options.

Keep in mind that as many as 80% lose money from trading in the long run. So, statistically, you’re more likely to lose money when trading options than you are making money.

Conclusion

Trading options can be straightforward when armed with the right broker and information. For beginners, we trust this guide has provided valuable insights, empowering you to confidently kickstart your investment journey. Remember, every win or loss is a stepping stone towards success. Therefore, remain disciplined and patient if you want to become an independent options trader. You should also avoid letting emotions dictate your decisions and stick to your trading plans. Most importantly, implement robust risk management practices and regularly monitor your open positions to ensure they align with your trading expectations.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.

Can you tell more about SpreadEx commissions and fees? What is their minimum deposit? I've heard a lot of good feedbacks, but I'm not ready to invest a large amount yet

SpreadEx does not have a minimum deposit making it a perfect option for beginners. Also, spread betting is commission-free as well as tax-free (in the UK). Therefore, SpreadEx is a perfect choice for those with a limited budget.

Listing all of SpreadEx trading and non-trading fees is a huge undertaking, which is why we suggest that you visit the SpreadEx website and take a close look at the fees that will apply to you and your trading strategies.

All in all, SpreadEx is a cheap broker to use in the UK!

What is the lowest cost options trading platform, that isn’t incredibly restrictive on allowing you to trade?

IG Markets is the BEST options trading platform! This broker offers a very user-friendly interface and everything you need to trade easily and efficiently!!!

The best options trading platforms: IG Markets and Interactive Brokers. For professionals, Interactive Brokers takes the crown as the best options platform. I choose this platform for options trading because at Interactive Brokers, there is no base charge. Additional savings are also realized through more frequent trading.

here are several strategies which one can use in Option Trading depending on whether the market or stock is expected to be in bullish, bearish, sideways trend or is volatile in near future.

Bullish Strategies :

Long Call, Naked Put, Covered Call, Protective Put, Bull Call Spread, Bull Put Spread, Call Back Spread, etc.

Bearish Strategies :

Long Put, Naked Call, Bear Call Spread, Bear Put Spread, Put Back Spread, etc.

Neutral Strategies :

Short Straddle, Short Strangle, Long Butterfly, Collar, etc.

Volatile Strategies :

Long Straddle and Long Strangle

Let us discuss the parameters which are essential for a broker for seamless options trading.

Technology:- The broker needs to have a platform backed up by robust and advanced technology. There needs to be a lesser number of technical snags or at the best, there should not be a technical snag at all. Almost all the full-service brokers are fine in this aspect.

Brokerage:- If you are a trader with lesser volumes and infrequent trades, better to go to full service brokers. If you trade frequently or in higher volumes, take the service of discount brokers as you can save significantly on brokerage and the subsequent taxes on it.

Back Office & Support:- You need to have a good service in the back office such that any of your queries/problems are solved faster. Pay-in and Pay-outs should take plae without any snag/delay.

Technical Charts:- If you are into technical analysis or interested to learn in it, never compromise. You need to have the best interface for charts.

Some options traders need to understand how trading derivatives can really help to enhance portfolio returns. Turnkey Forex, E*Trade, and Pepper-stone are advanced brokers that are elegantly designed to offer the best-in-class services to traders of different experience levels. The extensive range of trader resources as well as educational tools will help you graduate to options along with derivatives. You can start by opening a demo account to understand the workings of Turnkey Forex and E*Trade using their website or mobile application to learn more about them and the trading market.

For a person who decided to start trading options, the article turned out to be incredibly instructive. She answered my questions easily, providing detailed guidance from understanding the basics to choosing a reliable broker. A breakdown of options types, trading strategies, and platform comparisons provided clarity. Real-life examples of popular assets for trading further enhanced its practicality. This article has become my go-to resource and has given me the confidence to begin my options trading journey.

Hello guys, just want to tell you about my experience in options trading. Found this awesome guide on the best options trading platforms and it has added to my knowledge. Breaks down call and put options in an easy to understand manner, emphasizes the importance of risk management and talks about potential scams. Strategies and understanding of options pricing factors have enhanced my trading skills. Seriously, a must read for traders everywhere - clear, practical and worth the effort!

Having thoroughly explored various options trading platforms, I find the information in this article highly interesting and relevant. User reviews provide a comprehensive overview of platforms I'm not yet familiar with, and the recommended platforms align with my positive experiences. The guide covers crucial aspects, from understanding options to practical strategies. As an experienced trader, I appreciate the focus on risk management and the diverse range of discussed options strategies. A comprehensive resource for both beginners and seasoned traders.

Wow, this is fascinating! I've always been unsure about what's better: trading options or stocks? The article shed light on this question, explaining that options trading might be more advantageous due to lower initial capital requirements and the ability to hedge against market volatility. Now I understand that options offer more flexibility and less risk, making them an appealing investment tool. Thanks to this article, I'm ready to try my hand at options trading!

Great insights into the top options trading brokers! It's really helpful to have a detailed review for each platform. I’m particularly interested in the features of the brokers you've highlighted.

I’d recommend adding eToro for its user-friendly interface and social trading features, which can be great for those looking to follow experienced traders.

Great insights on the options trading brokers! I found the comparisons very helpful, especially the focus on fees and user experience. It's refreshing to see such thorough reviews. Thanks for the effort put into this post!