Forex trading signals help traders identify potentially profitable opportunities. In the UK, many brokerage firms offer these signals as a way of supporting their clients. However, how would you identify the best provider with forex signals?

My guide below answers this question and more. Not only will I introduce you to the best forex signal providers for 2026, but also take you through the simplest way of choosing an option that aligns with your trading requirements.

List of the Best Forex Signal Providers

After conducting multiple tests and fact-checking over 20 UK providers with forex signals, here are my top picks.

- FxPro – Best With High Leverage Limit

- Forex.com – Overall Best

- ForexSignals.com – Top Option For Advanced Traders

- FP Markets – Cheapest Provider

- MQL5 – Best Provider for MT4 and MT5 Traders

Provider Reviews

While testing and comparing the 20+ forex signal providers, I noticed that each has its unique offering. This means that every trader’s needs are catered for by these providers. You simply have to identify a suitable option for you.

To help you make quick decisions or choices, I have shared my top forex signal providers’ mini-reviews below. They highlight the key features that make them stand out.

1. FxPro – Best With High Leverage Limit

If you are a professional trader in search of a provider with high leverage limits, try FxPro. It combines impressive signal accuracy with high-leverage options, thus making it worth recommending. I found more than 70 currency pairs on this provider, and I believe that gives traders a wide array of opportunities for well-informed trading decisions.

What is unique among other things with FxPro are the leverage limits, such as 1:30 for retail clients and the attractive 1:500 for professional clients. However, my advice will be that you approach leverage trading with caution. Because just like it can bring you good profits, it can also leave you with massive losses.

Another impressive feature at FxPro is the professional support service team. Although available for five days a week, the team solves traders’ queries effectively and in time.

Find out more about the best high-leverage brokers in the UK in our other guide.

- Low deposit of £100 minimum without any deposit fees

- Low cost of forex trading

- A user-friendly platform including FxPro WebTrader, cTrader, MT4, and MT5, with quality trading tools

- High leverage limit of 1:500 – may maximise profit if a trade works out in your favour

- Support service works on weekdays only

- No buying and taking full ownership of featured securities

| Type | Fee |

| Minimum deposit | £100 |

| Withdrawal fee | £0 |

| Inactivity fee | £15 once + £5 monthly |

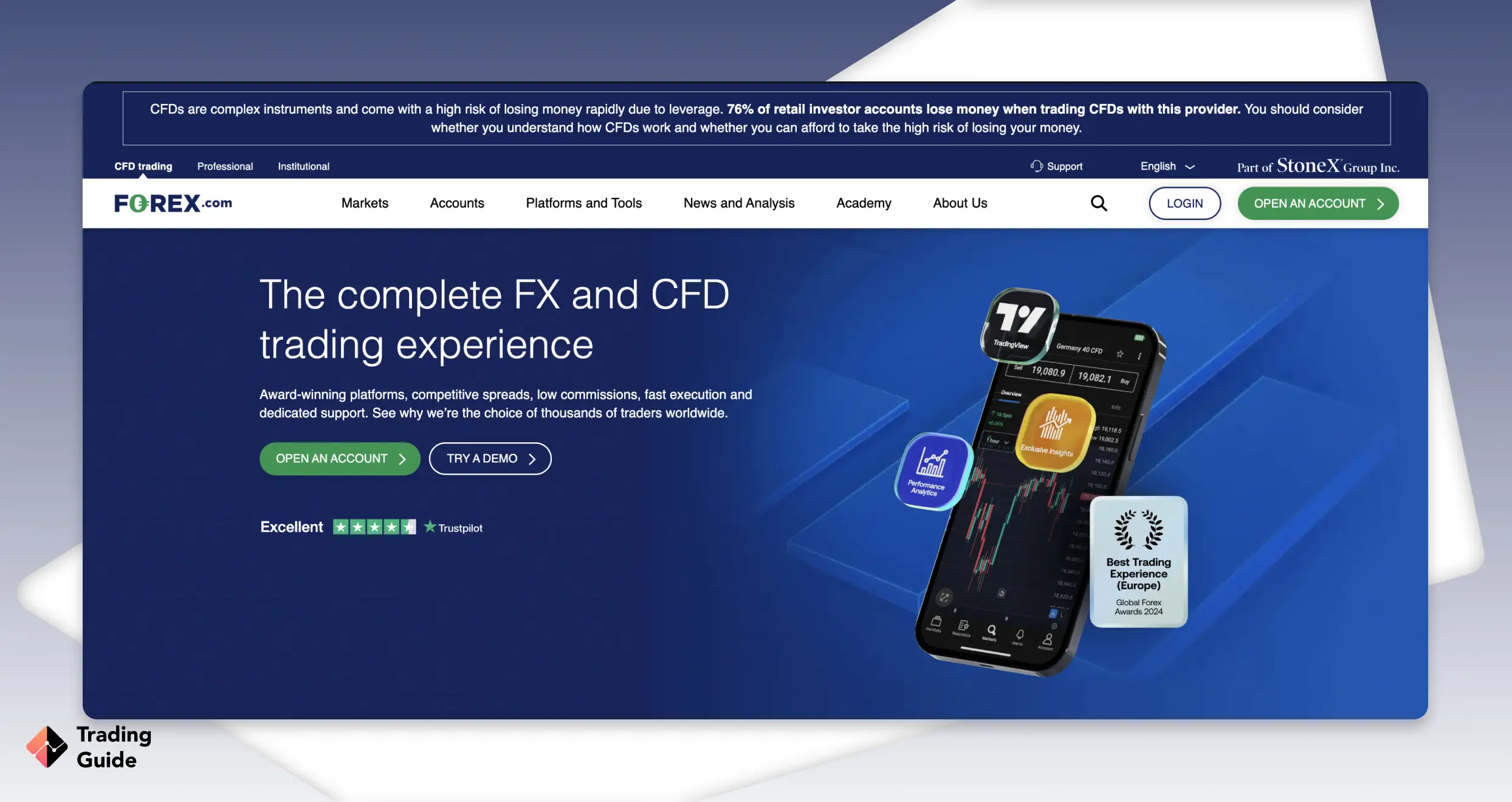

2. Forex.com – Overall Best

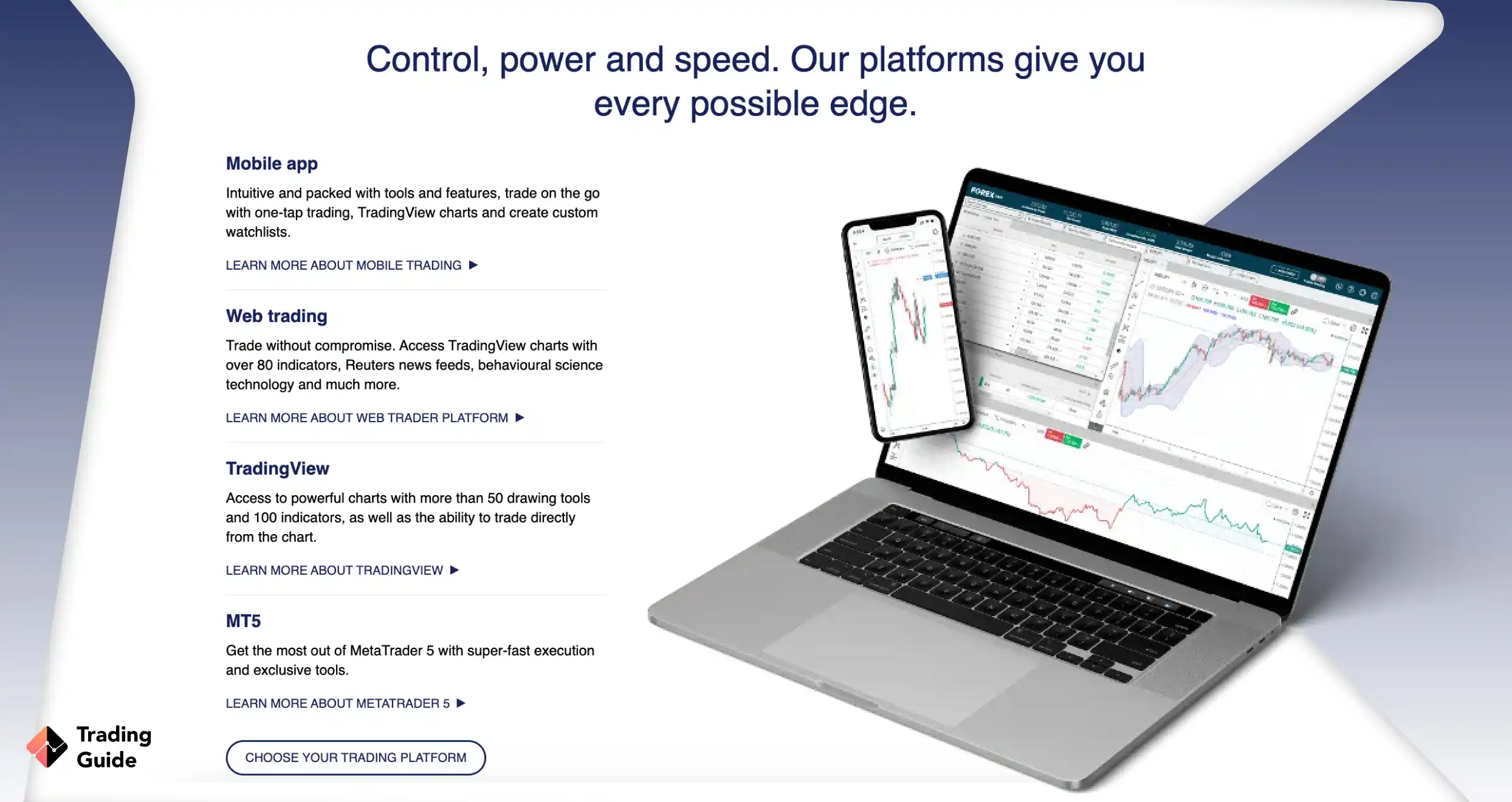

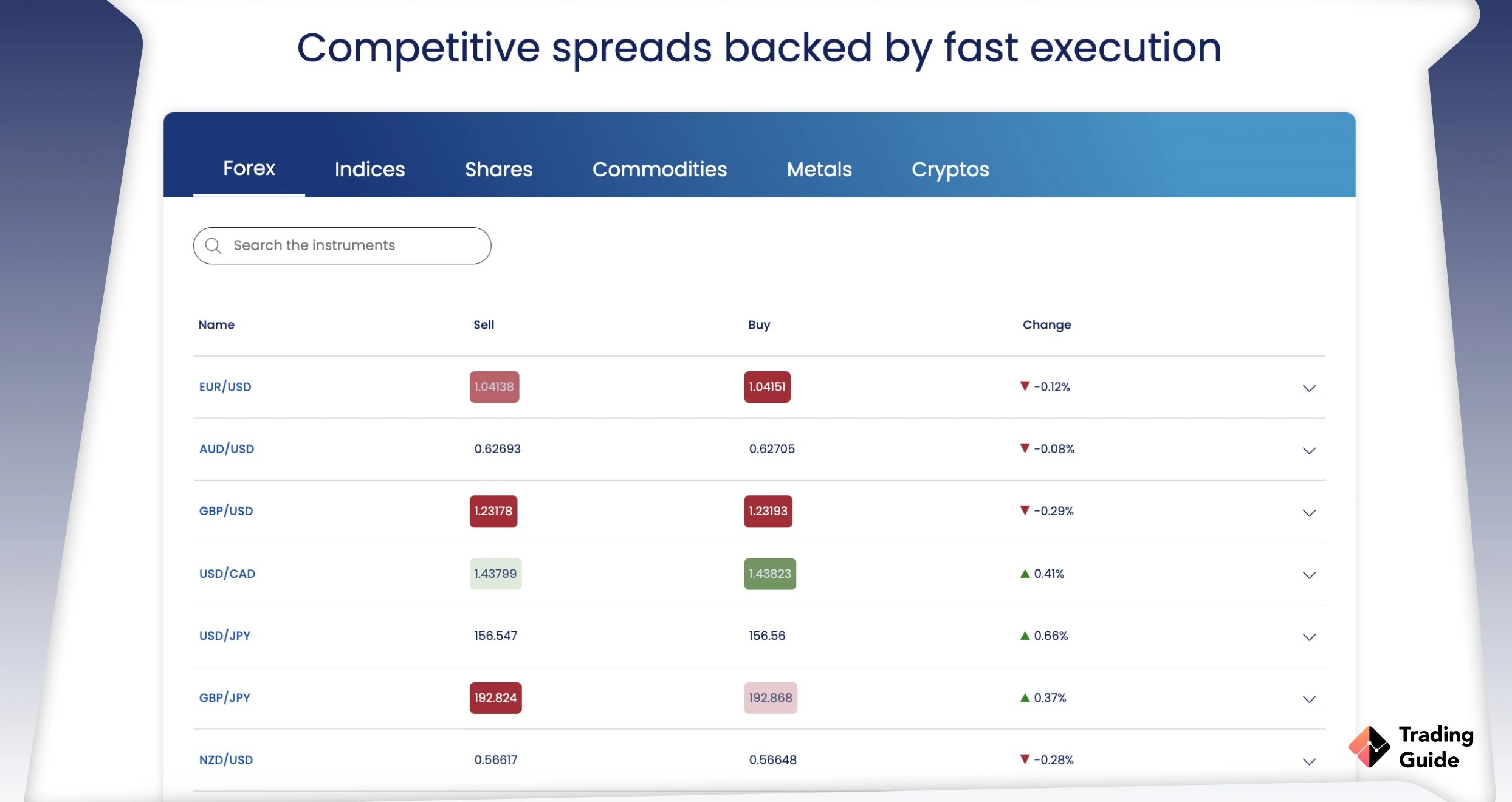

I consider Forex.com one of the most highly rated forex brokerage firms in the UK. Like others that I recommend here, it is regulated by the FCA in the UK. It offers over 80 currency pairs to choose from and allows you to trade 24 hours, five days a week.

Forex.com hosts some of the most advanced trading platforms, including WebTrader, TradingView, and MT4, which are available with better indicators like pivot points to help you find the best entry and exit points.

In addition, this forex signal provider has integrated an advanced tool known as the Autochartist. This tool is designed to scan the currency market automatically for potentially profitable opportunities. This tool identifies chart patterns and predicts them based on technical analysis of such patterns. You will also love its Recognia technical analysis portal. It helps streamline trading strategies for better and greater potential.

- Low minimum deposit requirement of £100

- Access to 80+ currency pairs

- Features an Autochartist advanced tool to simplify your activities

- Low spreads

- Multiple platforms to suit all traders’ unique requirements

- Charges an inactivity fee that kicks in after 12 months of no activity

- Does not offer the MT5 platform to UK clients

| Type | Fee |

| Minimum deposit | $100 |

| Inactivity fee | $15 |

| Deposit fee | $0 |

| Withdrawal fee | $0 |

| Overnight fee | $0 |

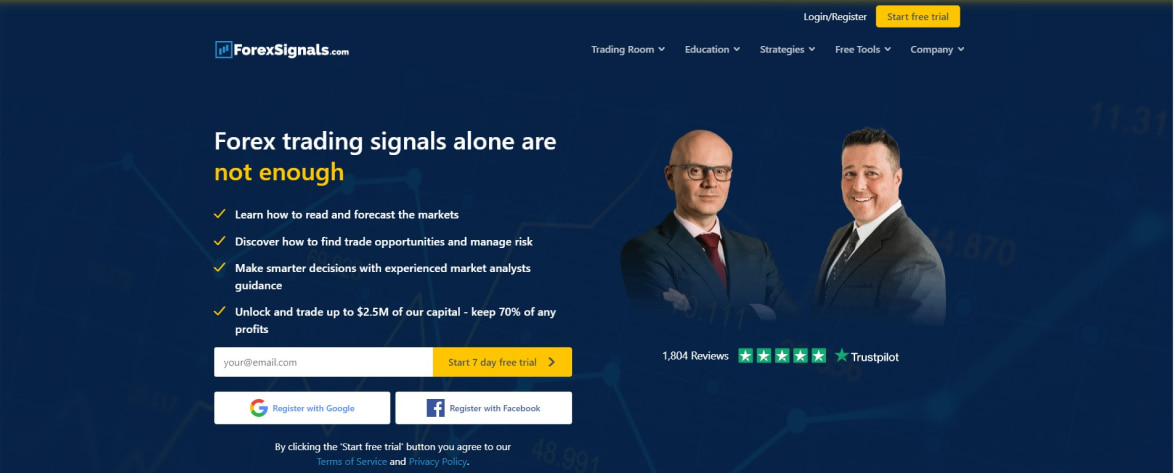

3. ForexSignals.com – Top Option For Advanced Traders

ForexSignals.com prides itself on serving over 83,000 active global users. From my analysis and experience, it delivers a wide range of tools to help you improve your skills and become an independent forex trader. With this provider, you get to benefit from quality forex signals from professional mentors.

Additionally, ForexSignals.com features a live stream where users can learn more about forex trading and easily navigate the currency market. The provider’s professionals have decades of experience in the financial landscape. Therefore, you can rely on their advice and trading tips to make informed decisions.

I like that ForexSignals.com has partnered with Howtotrade.com to ensure you are fully informed. Besides benefiting from trading analysts, you are guaranteed a more comprehensive educational experience. You can learn to develop and implement your strategies on this platform while exploring day-to-day trading instruments.

- Offers a wide range of learning resources

- Availability of numerous forex signal tools for in-depth analysis

- Compatible with desktop and mobile devices

- Features live streams and video tutorials

- Its monthly subscription package does not include all services

- You may want to consider other providers if you are looking for passive forex signals

The costs per month start at $47.25 when paying for a year in advance. The month-by-month subscription – $97 per month. The 7-day free trial for free.

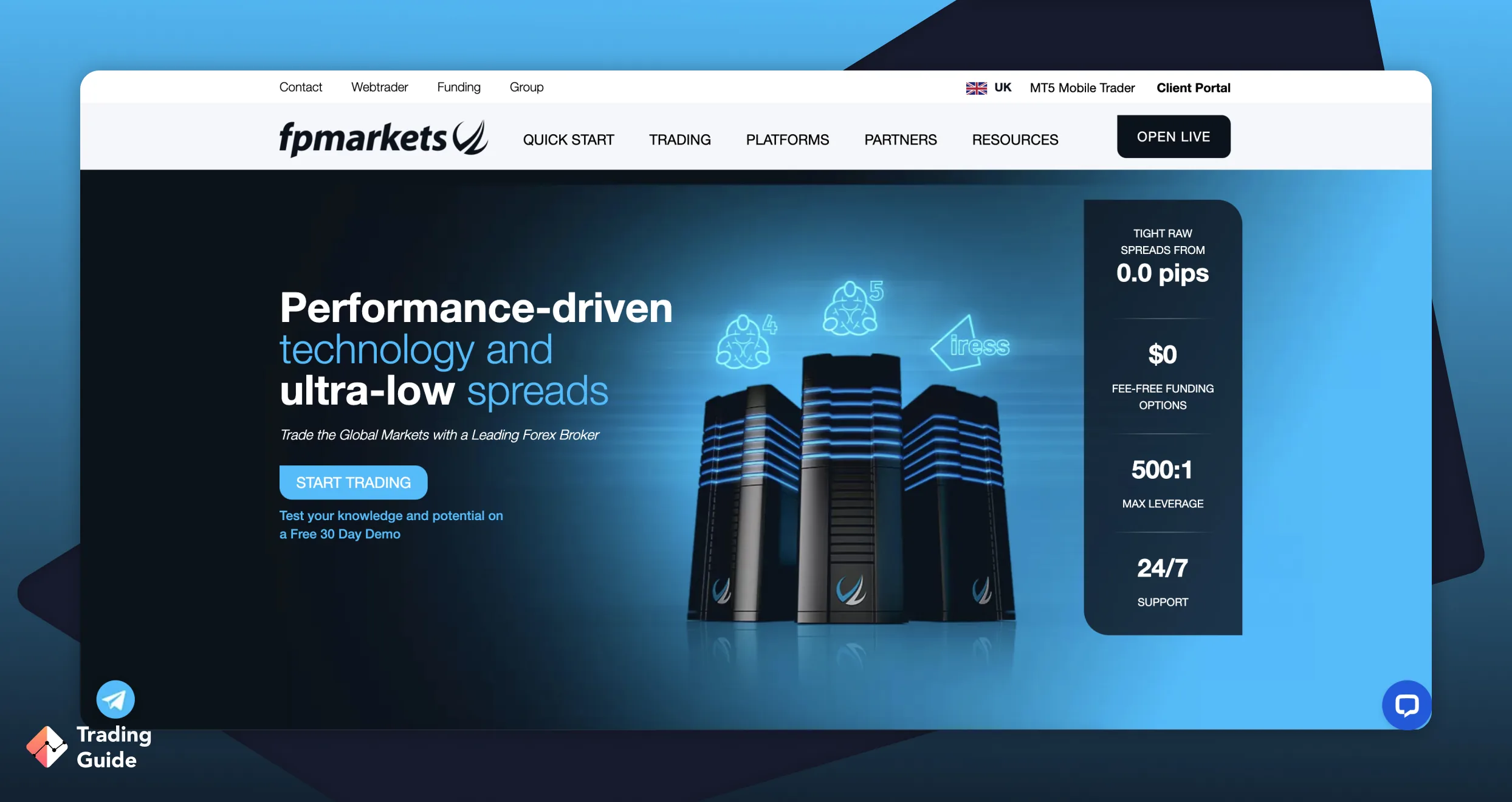

4. FP Markets – Cheapest Provider

While I encountered many cheap forex signal providers in the UK, I rank FP Markets in this category for various reasons. First, I like that it is one of the providers with low minimum deposit requirements. UK traders can sign up for live accounts and get started with as little as £100.

Note that depositing funds at FP Markets is free of charge regardless of the payment method you are using. And when you trade forex, the spreads you will incur are low, starting from 0.0 pips. I believe such transparency in trading and non-trading fees makes it easier for users to budget without worrying about extra costs.

When it comes to the number of currency pairs, I identified over 70 options. On top of that, the provider hosts additional assets so you can diversify your portfolio. These include shares, commodities, ETFs, and more. You can trade them on its multiple platforms, namely MT4, MT5, cTrader, TradingView, and WebTrader.

Forex signals are available via the “Signal Start” platform. All you have to do is pay a subscription fee of $25/month to access basic facilities, including a list of professional signal providers with their performance metrics. For advanced analytics and in-depth analysis, Signal Start offers additional monthly subscription tiers ranging from around $30 to $100.

For professional traders, you can enjoy this broker’s Expert Advisors and VPS services for automated trading

- List over 70 currency pairs and an additional 10,000+ securities for portfolio diversification

- Low minimum deposit requirement with zero transaction charges

- Low forex trading spreads and signals services fee compared to most forex brokers

- Plenty of free learning materials for skills development

- Lists only CFD assets

- The availability of risk management tools can be improved

| Type | Fee |

| Minimum deposit | $100 |

| Overnight fee | $0 |

| Deposit fee | $0 |

| Withdrawal fee | Depends on payment method |

| Inactivity fee | $0 |

5. MQL5 – Best Provider for MT4 and MT5 Traders

MQL5 boasts a wide range of trading resources suitable for traders using both the MT4 and MT5 platforms. I noticed that this allows one to connect with professional traders and copy their trades directly through their respective MetaTrader platforms.

The copy trading feature has been reliable for thousands of traders, especially the less skilled in the financial landscape. You will, however, have to study the traders properly before copying their positions since MQL5 doesn’t curate or endorse individual traders. That also means you should choose very carefully who you want to follow.

On the bright side, MQL5 is very open and trustworthy. The service provider tests the performance records of his signal providers to verify their reliability. Although the site is free to use, you will have to bear in mind the various fees charged by each individual trader you copy. Additionally, MQL5 is compatible with any MT4 and MT5 brokers, allowing you to choose the one that best suits your trading needs.

- A highly rated copy trading platform for MT4 and MT5 users

- User-friendly platform with a modern design perfect for newbies

- Offers a wide selection of trading tools for your market analysis

- Low investment requirement

- Not regulated

- Its ability to thoroughly filter traders can inconvenience users

- MQL5 itself doesn’t directly charge fees—those are set by your broker.

- Some services in the MQL5 Market, such as buying or renting Expert Advisors or Indicators, come with a fee.

- Deposit/Withdrawal Fees: These may vary based on the payment method used, and brokers might impose fees on certain withdrawal methods.

Compare Providers Table

You’re probably wondering how I came up with the above recommendations. Well, as I mentioned above, I identified over 20 forex providers in the UK. I then tested and fact-checked them before making comparisons to shortlist what met my specifications.

Some of the features I looked into include regulatory status, encryption protocols, fees, minimum deposit requirements, support service, platform performance, and demo account.

I went further to check Google Play, App Store, and Trustpilot to see what other people are saying about their experiences with those providers. I paid attention to only those that received numerous positive reviews through the combination of my test results and findings in user ratings to make my final choices for recommendations.

This, in my view, is due to the special way in which I conduct research. I recommend based on facts only, a propensity that keeps me objective.

Here is my comparison table with the major features of the best providers in the UK.

| Best Forex Signal Provider | Minimum Deposit | Trading Assets | Software | Payment | Customer Support |

|---|---|---|---|---|---|

| FP Markets | £100 | Forex, stocks, commodities, ETFs | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trading App, MT5 Mobile Trader | Credit/Debit Cards, International/Domestic Bank Transfer, Neteller, Skrill, Fasapay, PayTrust88, Ngan Luong, PayPal, Bank of China Online Pay | 24/7 |

| FxPro | £100 | Forex, stocks, commodities, ETFs, cryptos | FxPro Mobile App, MT4, MT5, cTrader, FxPro WebTrader | Wire Transfers, Credit/Debit Cards, PayPal, Neteller, Skrill | 24/5 |

| Forex.com | £100 | Shares, forex, indices, commodities, cryptos | Mobile App, Web Trading, MT4, Tradingview | Bank Wire Transfer, Credit/Debit Cards, E-wallets, Skrill, Neteller, PayPal | 24/5 |

| ForexSignals.com | From £40 | Forex, commodities, stock indices, cryptos, stocks | ForexSignals.com Live Trading Room, Trade Copier | Credit/debit cards, PayPal, Bank transfers, Crypto | 24/7 |

| MQL5 | Vary | Forex, stocks, commodities, stock indices, cryptos | MT5, MQL5 Market, MQL5 Cloud Network, MQL5 Signals | Credit/debit cards, PayPal, Bank transfer, Electronic payment systems | 24/7 |

Are you wondering how to trade on forex? Read our complete guide for beginners about it.

How to Choose a Forex Signal Provider

Engaging in forex trading necessitates a firm grasp of its dynamic nature, which involves trading currency pairs and substantial market volatility, leading to potential gains as well as losses. Before entering the forex market, crafting a well-defined trading strategy and establishing a robust risk management plan to safeguard your investments is essential.

Moreover, exercising caution is imperative, as there is a risk of encountering forex broker scams and unregulated platforms. Since this market operates 24/7, always invest with what you can afford to lose. Plus, stay informed about market developments and continuously educate yourself to make well-informed trading decisions.

Remember that past performance does not indicate future results, and there are no guarantees of profit in forex trading.

Choosing a forex signal provider requires careful consideration to ensure you identify what meets your unique trading needs.

Below is what to look for when making a choice.

My advice to you as a new trader, always first look for safety before venturing into forex and any financial activities. So, in this case, a provider or broker must have highly encrypted protocols that have given assurance and warranty of the safety of private data.

If a broker boasts of accepting UK clients, check its regulatory status. Only FCA-regulated ones deserve your attention, offering favourable conditions for trading. The safety of your funds will be guaranteed too.

Do not just settle down with any provider just because it is safe. Make sure that it is user-friendly and would not cause one problem on the website while trying to navigate through. See that the speed of trading within the platform is considerably good, and can be accessed with desktops and mobile phones.

Note that some of these providers even give access to third-party platforms such as MT4, MT5, cTrader, among others. If you feel the provider’s proprietary platform is not ideal for your skill level, then use the third-party options or find another provider.

I always have a budget before venturing into any activity in the financial landscape. It all comes down to selecting an affordable provider based on your trading strategy. Fees like commissions/spreads, transaction costs, inactivity fees, and more should not eat into your nest egg.

Some brokers offer commission-free services with high spreads, while others charge low spreads with high commissions.

Another aspect that you should not miss out on is the product you can find on a forex signal provider’s platform. Other than forex, what else can you look at and spread your portfolio with? It’s good to have options to spread risks so that chances of massive losses, which come with investing in just one security, are mitigated.

A provider with good support service deserves commitment. This is especially if you are a newbie who needs all the support you may get to know your way around the currency market landscape. The best option should have responsive customer support that can be contacted through multiple channels: phone, email, and live chat.

Also, availability is important. Whether 24/7 or 24/5, just make sure this fits into your schedule for forex trading.

Forex trading signals UK may come in lots of forms, including auto and human-generated ones, all from short-term and long-term trading horizons. Consider a type of signal that suits you and opt for a matching service. For instance, if you want to try longer-term trading approaches, then opt for a service that will allow you to get signals with broadened time horizons.

It is important that you settle with a provider that will serve you in many areas. Besides the above elements, it should host quality learning and research materials that boost your skill level to analyse the market. This element will keep you engaged long-term with the provider rather than changing every now and then.

Check the variety in the modes of payment offered by a forex signal provider. This should be for convenience so that transactions can be carried out quickly. My suggestions above provide a variety of payment methods. These are credit or debit cards, e-wallets, and bank transfers.

Follow up with the trading community to understand a provider’s reputation. Reviews and testimonials of current and previous users will help identify the strengths and weaknesses of a provider so as to make informed decisions. Understand that no brokerage firm can ever be perfect. You simply look for the one with many positive ratings.

Note: Overall, the best forex signal provider can highly affect your success in trading. Therefore, as much as the above elements may lead you to the best option, you need to test it and see how it performs. I always use the demo accounts offered by brokers to do this before committing any real money.

Conclusion

As an experienced trader and finance expert, I highly recommend incorporating forex trading signals in your activities. However, you must be willing to conduct a thorough market analysis to develop detailed strategies. Ensure you identify which signals to follow and which ones to avoid. Most importantly, have a credible and reliable provider for an exciting experience. While they do not guarantee profits, following my guidance will ensure you increase your chances of success. It’s all about remaining disciplined and sticking to your plan without being influenced by emotions.

How we test?

Our evaluation and testing process is thorough and exhaustive. First, we conduct extensive research. Our experts visit each broker’s official site and assess every offering. Then, we go to credible review sites like Trustpilot, Google Play, and the App Store and read user testimonials and feedback. After research, our experts proceed to the next step: testing.

The testing phase is critical in determining if brokers deliver as promised. We used demo and live accounts to vet available trading platforms, tools, and other resources. While doing so, our experts strive to identify the most pronounced strengths and weaknesses.

Why do we do all that? It’s simple. You are a valued member of the TradingGuide family, and we are committed to doing everything in our power to ensure you have access to the best brokers. Find out more about our test process here.