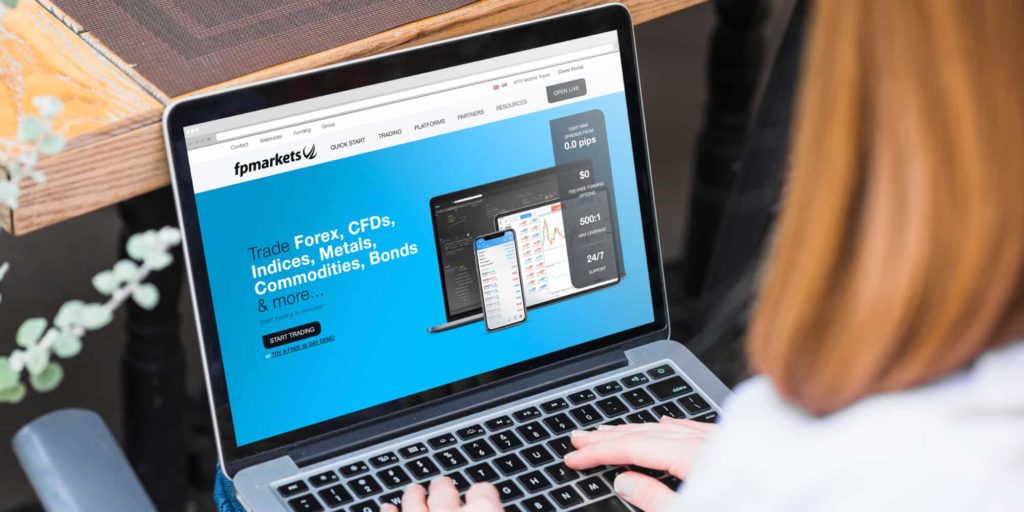

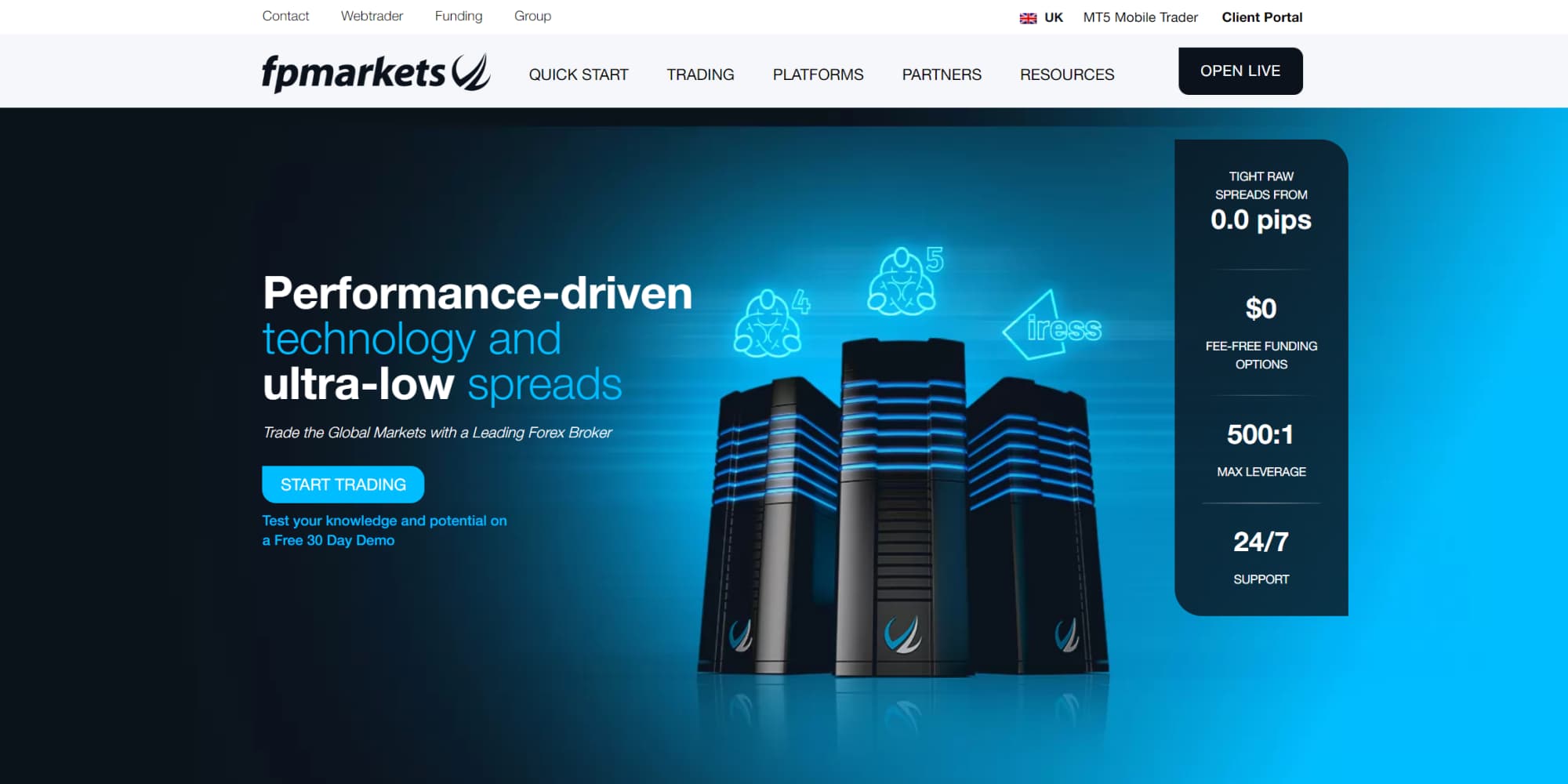

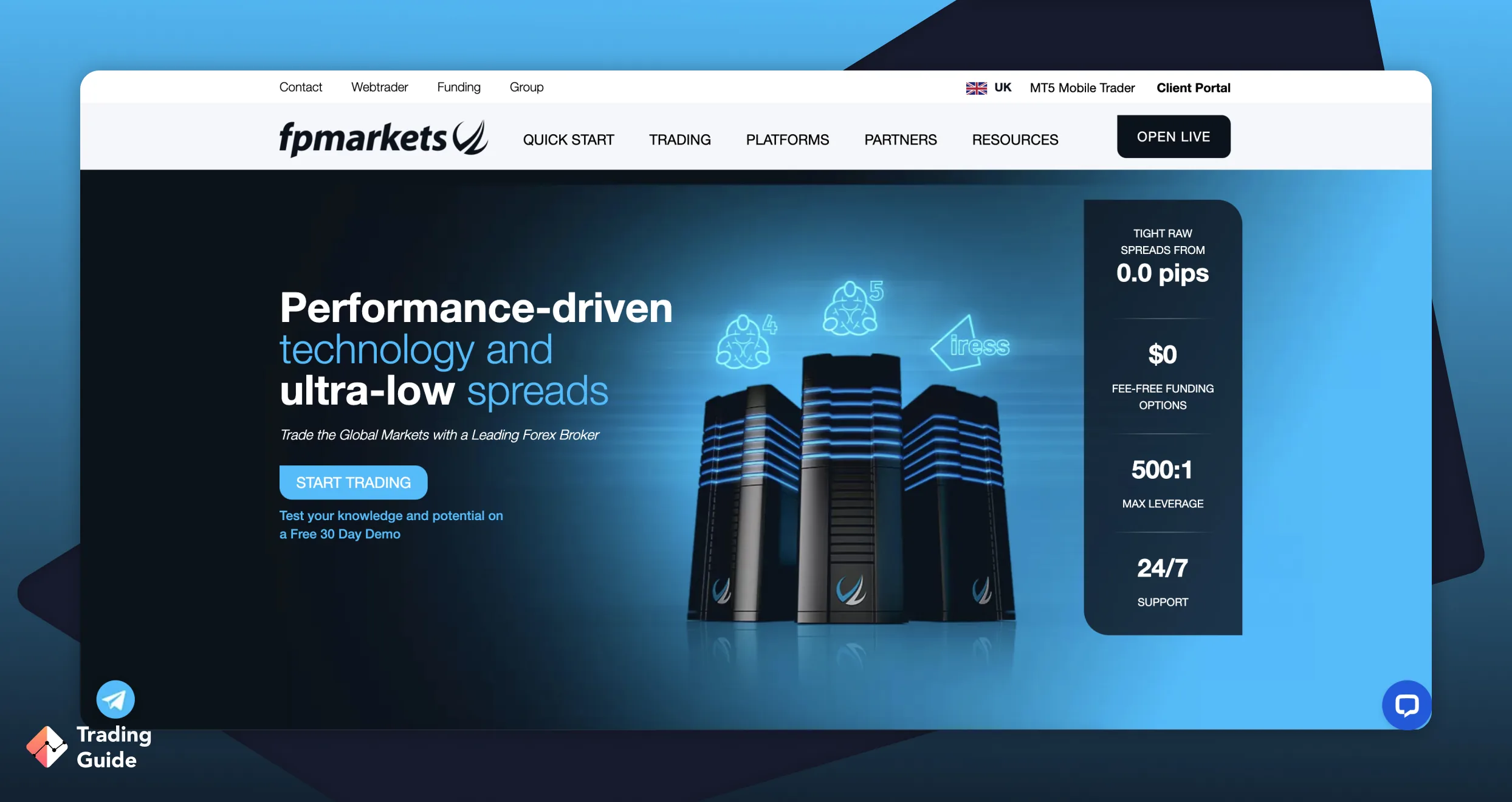

FP Markets is highly regulated by top-tier authorities such as the Australian Securities and Investment Commission (ASIC) and Cyprus Securities and Exchange Commission (CySEC). This award-winning broker offers consistently tighter spreads on its advanced platforms.

- Low minimum deposit of $100.

- Fast Account Opening.

- Low spreads on various currency pairs.

- 24/7 customer support.

- Limited range of instruments.

Founded in 2005 in Australia, FP Markets has been around for more than 15 years, navigating the tricky waters of the financial world. Traders all over the globe know about it because of its focus on new ideas, caring about its customers, and offering many ways to trade. As expert researchers and seasoned professional traders, our goal is to supply our readers with accurate and unbiased broker reviews. Therefore, we decided to shed light on FP Markets today, discussing every facet of this broker’s offerings. Below, you will learn more about FP Markets’ strengths and weaknesses and explore the opportunities it presents for traders in the ever-dynamic financial markets.

Our Opinion About FP Markets

FP Markets earns our admiration for its web and mobile trading platforms, making them a recommendation for traders of all levels. The standard platform is so user-friendly that even beginners can set up a trading account without needing extensive guidance. What’s even more appealing is the intuitive design of these platforms, ensuring smooth navigation for traders. We also liked the fact that FP Markets features social and copy trading platforms, which we highly advise you to take advantage of and enhance your trading experience.

When it comes to financial considerations, FP Markets asks for a minimum deposit of just $100. Plus, the broker boasts low fees, both for trading and non-trading activities. With these cost advantages in your arsenal, we firmly believe you can diversify your portfolio across a multitude of markets, substantially elevating your profit potential.

Overall, FP Markets is a top-tier choice for traders and investors alike. Its extensive track record is a testament to its domination in the financial market, earning the trust of countless forex and CFD traders, especially within Australia. With FP Markets, we encourage you to take a test voyage using its demo account. Practice forex and CFD trading in a risk-free environment before you embark on your real trading journey.

What We Like

- Low Minimum Deposit: FP Markets impresses with its low minimum deposit requirement of just £100, making it accessible to a wide range of traders.

- Extensive CFD Offering: With over 10,000 CFD assets available for trading, FP Markets provides a vast and diverse array of options for traders to explore.

- Competitive Spreads: Traders can benefit from low spreads starting at 0.0 pips, potentially reducing trading costs and maximising profit potential.

- Social and Copy Trading: FP Markets enriches the trading experience by offering social and copy trading platforms, particularly valuable for newcomers looking to learn and grow.

- User-Friendly Platforms: FP Markets’ web and mobile platforms are beginner-friendly and easy to navigate.

What We Don’t

- Limited Asset Selection: FP Markets is primarily focused on forex and CFD trading, which may not cater to traders seeking a broader range of asset classes.

- Absence of Price Plans: Unlike some brokers, FP Markets doesn’t offer specific price plans, which might leave traders looking for more pricing transparency.

FP Markets In-Depth

FP Markets, a well-established name in the world of online trading, offers a comprehensive suite of financial services. Known for its commitment to innovation and a client-centric approach, FP Markets caters to a diverse range of traders, from beginners to seasoned professionals. In the table below, we summarise the broker’s key features and offerings, providing a clear and concise overview of what you can expect when trading with it.

| Feature | Availability |

|---|---|

| Minimum deposit requirement | £100 |

| Licences | FCA, CySEC, FSA, CIRO, ASIC, CFTC |

| Demo account | Available (£50,000 virtual funds) |

| Advanced platforms | MT4, MT5, cTrader, Iress |

| Trading securities | Shares, commodities, cryptocurrencies, indices, bonds, and ETFs |

| Support service | 24/7 via phone, email, and live chat |

| Mobile app | Android, iOS |

| Stock investment cost | £0 |

Security

At FP Markets, the security of your investments and personal information is paramount. The broker employs highly advanced encryption technology to create a protective shield around your data. This level of encryption is designed to make it extremely challenging for any unauthorised parties to gain access to your sensitive information, ensuring your peace of mind.

FP Markets also demonstrates a strong commitment to regulatory compliance. The broker operates under the watchful eyes of multiple esteemed regulatory authorities. These include the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), Capital Markets Authority (CMA) in Kenya, and more. Such a broad spectrum of regulatory oversight reflects FP Markets’ dedication to adhering to rigorous standards and maintaining the highest levels of integrity and security.

The combination of advanced encryption measures and the supervision of multiple regulatory authorities makes FP Markets a reliable and secure choice for traders. We therefore give it a 4.8-star rating in this category.

Platform and Account Types

FP Markets offers diverse trading platforms to match various preferences and expertise levels. While exploring it, we noticed that the broker hosts a renowned MT4 that boasts a user-friendly interface and robust charting. We also traded on the MT5 platform, which provides extra features like timeframes, indicators, and an economic calendar. On top of that, FP Markets has the cTrader platform celebrated for its user-friendly design, and the Iress platform that caters to professional stock traders with advanced tools.

When it comes to account types, FP Markets has the ECN and DMA accounts offering competitive spreads and advanced resources for a straightforward forex and stock trading experience. FP Markets also respects unique preferences by offering Islamic accounts, compliant with Sharia law. These account choices, coupled with diverse platforms, allow traders to align with their trading objectives and styles. We therefore rate this section with 4.8 stars.

Platform Commissions

| Platform | Cost per month |

|---|---|

| IressTrader/ViewPoint | $60 |

| ViewPoint Essential | Free |

| Iress Mobile | Free |

| ViewPoint Essential | Free |

Fees

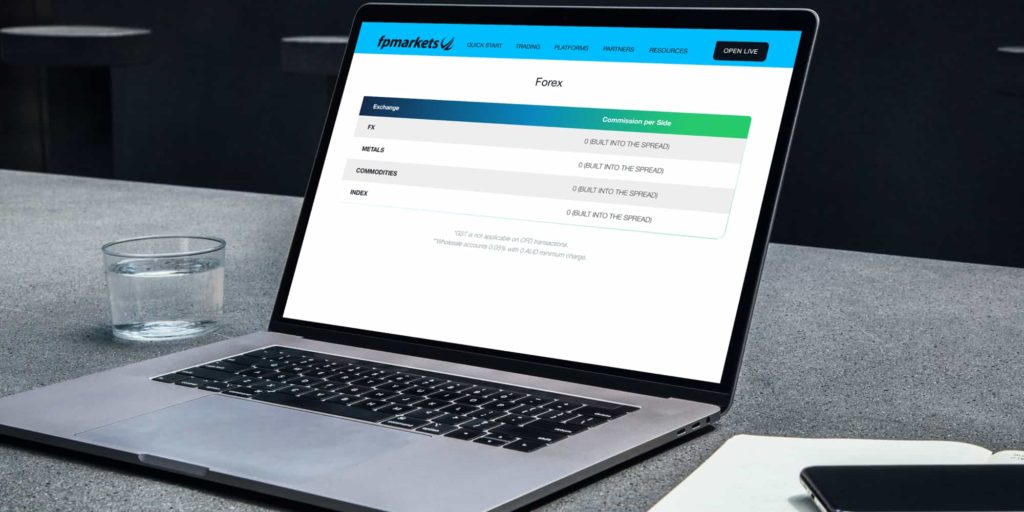

FP Markets offers competitive trading fees with variable spreads depending on the account type and market conditions. The Raw Account, ideal for scalpers, offers spreads starting from 0.0 pips. Importantly, FP Markets does not charge commissions on forex trades, enhancing affordability.

In terms of non-trading fees, FP Markets stands out for not imposing account maintenance or inactivity fees. While deposits and withdrawals are typically fee-free, expect to incur extra charges for positions left overnight. Overall, this broker is one of the most affordable, and we give it a 4.3-star rating.

| Type | Fee |

|---|---|

| Deposit Fee | £0 |

| Withdrawal Fee | £0 |

| Inactivity Fee | £0 |

| Overnight Charges | Based on the value of your CFD position |

| Margin Rate | From 1% |

Mobile Compatibility

FP Markets shines in terms of mobile compatibility, offering traders a seamless and user-friendly experience on the go. The broker understands the importance of accessibility and has invested in optimising its platforms for mobile devices. Whether you’re using a smartphone or tablet, FP Markets’ mobile apps, available for both Android and iOS, deliver a responsive and intuitive trading experience.

FP Markets mobile app mirrors the functionality of its desktop platforms, ensuring that you have access to critical features such as real-time charting, technical analysis tools, and order execution. This means you can monitor your positions, execute trades, and stay updated on market developments from virtually anywhere. The well-designed interface makes navigation effortless, and you’ll find it easy to manage your account, deposit or withdraw funds, and access educational resources. Based on our experience and FP Markets reviews from users, we give it a 4.7-star rating in this section.

Product Offerings

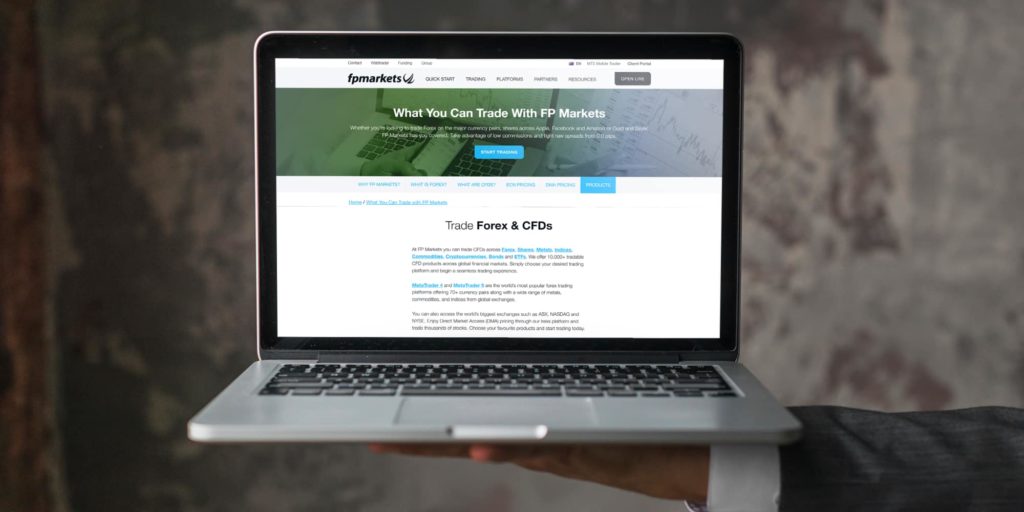

FP Markets offers over 10,000 forex and CFD products, providing traders with a comprehensive range of options to suit their investment strategies and preferences. With the availability of plenty of asset offerings, we rate it 4.4 stars and hope that it will someday allow the buying and taking full ownership of the assets.

Some of the key product offerings at FP Markets include:

- Forex: FP Markets is a reputable destination for forex traders. It provides access to over 70 major, minor, and exotic currency pairs, allowing traders to engage in the dynamic and highly liquid forex market.

- Indices: Traders can speculate on the performance of global stock indices, including popular ones like the S&P 500, NASDAQ, FTSE 100, and more.

- Commodities: FP Markets enables traders to invest in commodities, such as gold, silver, oil, and other precious metals and energy resources. These commodities often serve as a hedge against inflation and market volatility.

- Equities: The broker offers equity CFDs, allowing traders to take positions on individual stocks from various global exchanges.

- Cryptocurrencies: Cryptocurrency enthusiasts can access a range of digital assets, including Bitcoin, Ethereum, Ripple, and more, through CFD trading.

- Bonds: Traders can engage in bond trading, providing exposure to fixed-income securities, government bonds, and corporate bonds, which can be an essential component of a diversified portfolio.

Education Tools

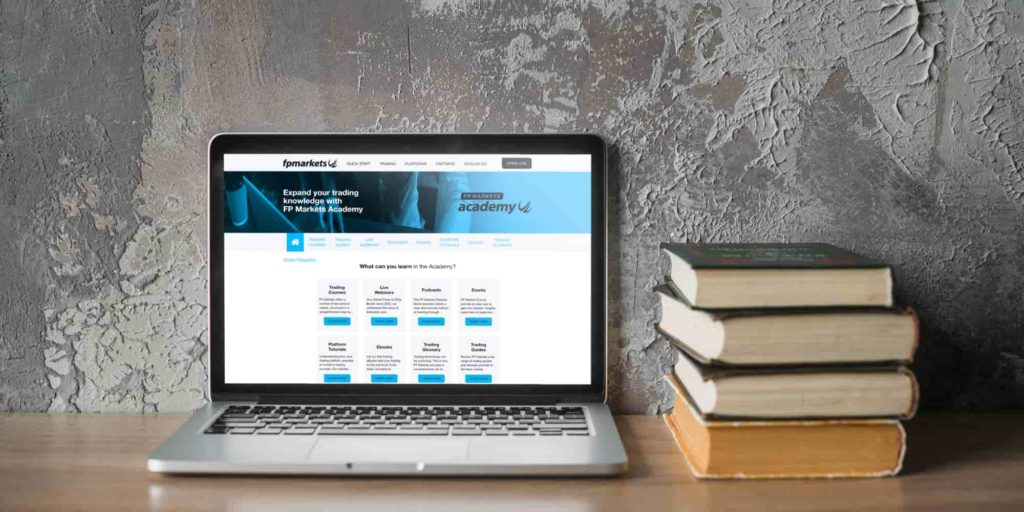

FP Markets places a strong emphasis on trader education, offering a range of resources to enhance trading skills. Traders can access educational articles, video tutorials, and webinars, providing insights into various trading topics. These resources cover technical and fundamental analysis, risk management, and trading psychology. Additionally, the broker offers an economic calendar, market analysis reports, and a comprehensive trading glossary to keep traders informed about market events. The availability of a demo account with virtual funds further supports skill development and confidence building, making FP Markets a broker committed to empowering traders with knowledge. In this section, the broker earns a 4.7-star rating from us.

Customer Service

We tested FP Markets’ support service reliability and responsiveness and were impressed with our experience. The broker offers robust customer service with 24/7 availability, ensuring traders can receive assistance whenever needed. Its multilingual support team caters to a global clientele, offering support through various channels, including email, phone, and live chat. This accessibility, coupled with the availability of personal account managers for specific accounts, ensures traders have the support they require. The broker also provides a valuable FAQ section and educational resources, promoting self-help and knowledge enhancement. With prompt responses and a commitment to client feedback, FP Markets earns a 4.6-star rating from us.

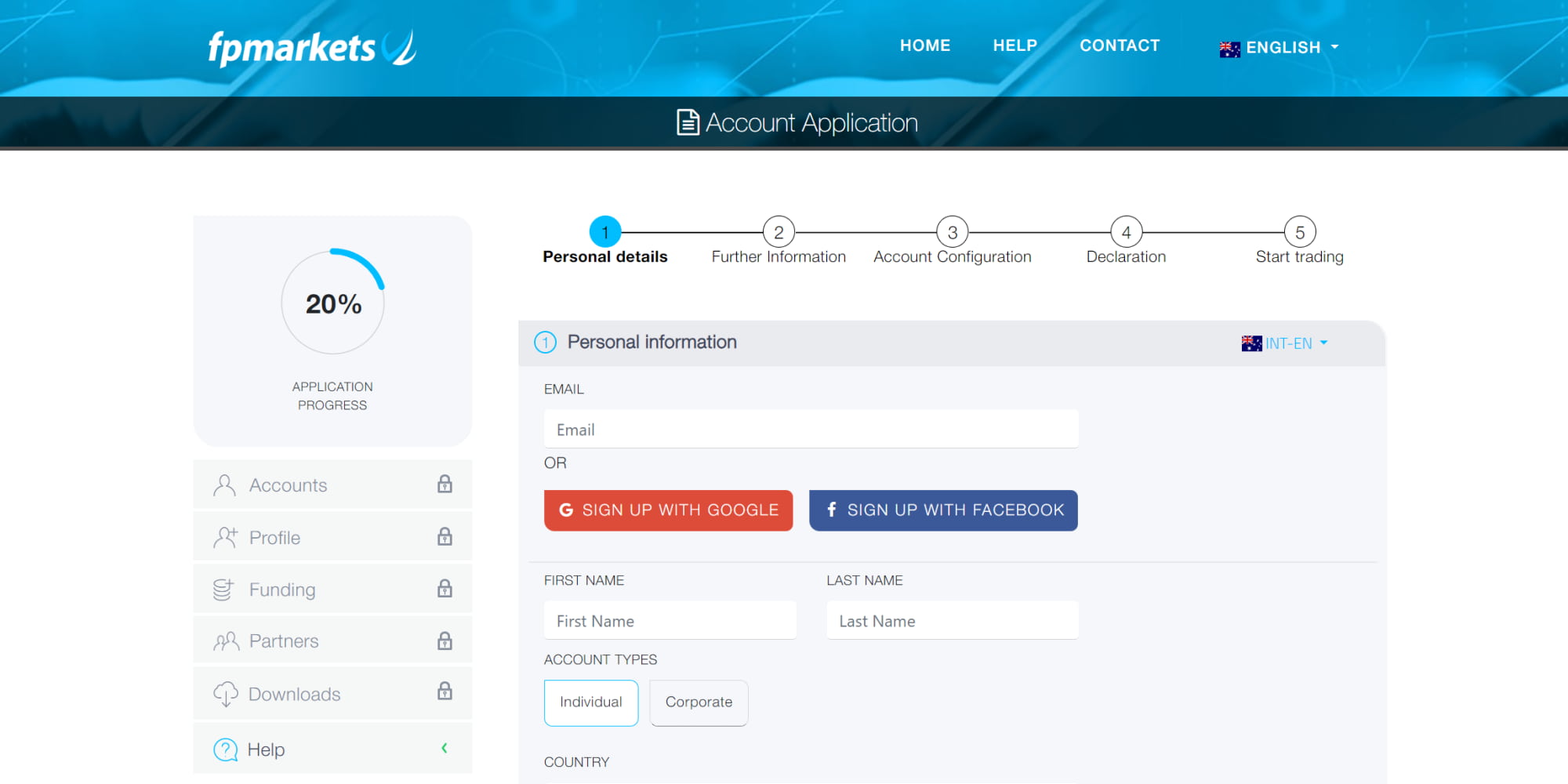

How to Sign Up For an Account at FP Markets

Based on our experience exploring FP Markets, we can confidently say that it is one of the most user-friendly brokers with simple account opening procedures. If you are considering joining the FP Markets community, here are the simple steps to setting up an account and getting started.

Start by visiting the FP Markets’ official website. You can access the site via your web browser on a computer or mobile device. Alternatively, click on any link we have shared here for quick access. Ensure you’re on the secure and official website for the safety of your personal information. Also, read and understand the broker’s terms and conditions and install its app on your mobile device if you are always on the move.

On the FP Markets website, you’ll find an option to ‘Open Live.’ Click on this button to begin the account registration process. You’ll be prompted to provide your personal details, including your full name, email address, phone number, and residential address. Ensure that the information you provide is accurate and matches your official identification documents. Also, create a username and a strong password for an additional layer of security.

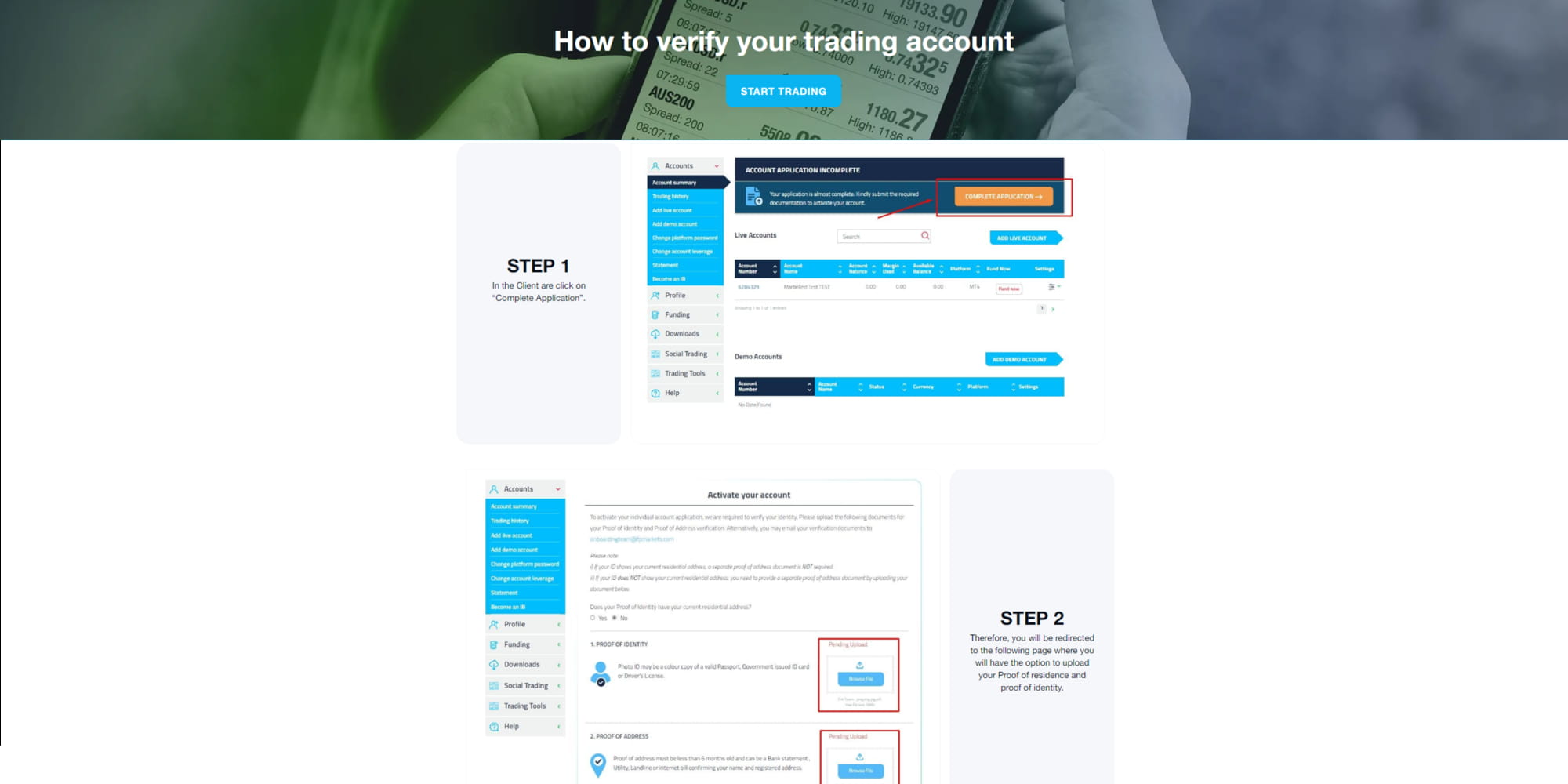

After completing the registration form, FP Markets will require you to verify your identity. This is a crucial step in compliance with regulatory standards. You’ll need to provide scanned or photographed copies of identification documents, such as your passport or driver’s license, as well as proof of address, like a utility bill or bank statement. Follow the instructions provided by FP Markets for submitting these documents. Once your account is verified, you’ll receive an email confirmation.

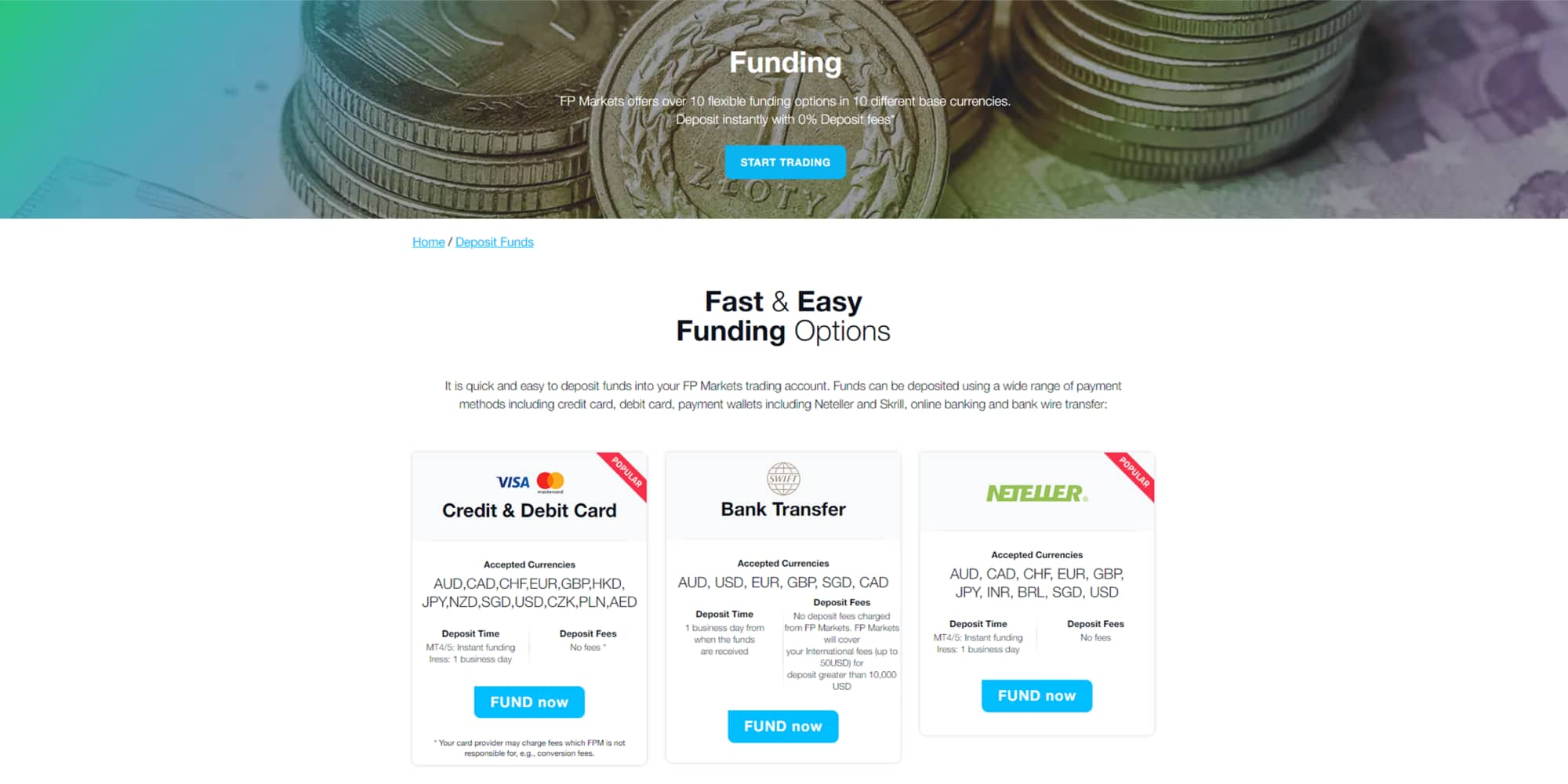

With your verified account, it’s time to fund it. Log in to your FP Markets account and navigate to the deposit section. Choose your preferred deposit method, such as bank transfer, credit/debit card, or e-wallet. Follow the on-screen instructions to complete your deposit. FP Markets typically offers various funding options to cater to your needs with no deposit charges.

With funds in your account, you’re now ready to start trading. You can access FP Markets’ trading platforms and explore their extensive range of tradable CFD instruments, including forex, indices, commodities, equities, cryptocurrencies, and more. Remember to employ sound risk management strategies and conduct thorough research before executing your trades. Also, remember that CFD trading carries a risk of losing a lot of money when approached with leverage. So, only trade with amounts you are comfortable losing.

Alternative to FP Markets

In the world of online trading, having options is key to finding the right fit for your unique needs and preferences. While FP Markets has amazing features for an exciting experience, it might not fit your trading requirements. With this comprehensive table, you can explore alternatives to FP Markets and determine which broker aligns best with your trading goals.

| Broker | Minimum Deposit | Demo Account | Mobile App | Commission/Spread |

|---|---|---|---|---|

| Plus500* 80% of retail investor accounts lose money when trading CFDs with this provider. | £100 | Available | Android, iOS | Spreads only |

| XTB | £0 | Available | Android, iOS | Yes |

| Pepperstone | £500 | Available | Android, iOS | Yes |

| OANDA | £0 | Available | Android, iOS | Yes |

Is FP Markets Good For You?

FP Markets can be a suitable choice for traders with varying levels of experience. With user-friendly platforms like MT4 for forex traders and advanced options like MT5 and cTrader for seasoned users, the broker offers versatility. The availability of different account types, competitive fee structures, and over 10,000 tradable instruments make it appealing for traders seeking diverse opportunities.

Additionally, FP Markets’ educational resources and responsive customer support enhance the overall trading experience. However, it’s crucial to evaluate your trading goals, risk tolerance, and budget to determine if FP Markets aligns with your specific needs. Conduct thorough research and consider trying their demo account before making a final decision.

FAQs

Yes. FP Markets is a trusted and reputable broker that has been operating since 2005. The broker’s activity is overseen by several top-tier financial authorities, including ASIC, CySEC, and FCA. Moreover, FP Markets has won multiple awards for its services, making thousands of users across the globe trust it with their funds and data.

FP Markets has a minimum deposit requirement of £100 for UK traders. You can make deposits and withdrawals using flexible payment options, including debit/credit cards, e-wallets, and bank transfers.

FP Markets prides itself on processing withdrawal requests as soon as possible. Most withdrawals, especially via e-wallets, are instant, while bank transfer withdrawal requests may take up to 24 hours.

No. Although FP Markets does not charge fees for account opening, account maintenance, or deposits, the broker charges commissions or spreads on trades. There are also other fees associated with certain services, such as overnight financing fees.

Yes. FP Markets has a good reputation among traders and has won multiple awards for its services. The broker offers a range of trading platforms, account types, and instruments, including forex, stocks, indices, cryptocurrencies, and more. It also provides educational resources and customer support in multiple languages.

FP Markets is a forex and CFD broker offering both Standard and Raw account types, all with low spreads and commissions. It also offers Islamic accounts for traders who follow Islamic finance principles.

Yes. FP Markets is beginner-friendly as it offers plenty of educational resources to help you boost your skill level. Plus, the broker features a user-friendly standard account and charges low fees for an exciting trading experience. You also have access to its demo account — a perfect platform to gauge your skill level free of charge.

I am new to forex trading and not sure whether I should use FP markets or not. Can I start with practicing on a demo account so that I can get an idea about how the forex broker works?

You should start with practicing on a demo account so that you can get an idea of how the forex broker works. I did the same when I was confused about choosing my brokers. I created my demo accounts with different brokers so that I could compare and decide.

I currently trade with FP Markets, because it is one of the oldest brokers in the forex business. I have been trading with them for a year and the spreads offered are lower and consistent even during high volatile market movements.

I try this FP Markets Demo Account and I can say that is really cool!! I can do as much buying and selling I want for many months and not have to pay anything

I've probably been looking for a good broker with low floating spreads for about a year. On the advice of a friend, I opened an account with broker FP Markets. This account offers all the necessary and the most favorable conditions for trading. The great advantage of this broker is that there is minimal deposit amount, you can replenish your account even for 100 dollars. Another of the broker's amazing offerings is that there is no minimum distance to a stop loss, I have not tried setting a stop loss one point away from an order, I think it will work if done that way. In short, a broker with great conditions.

Well, I’m speechless with the service provided by my account manager. Thank you so much. I will recommend FP Markets to all my friends. Keep up the excellent work. I like it!

I have been using FP Markets for about 3 years now for my forex trading. In all they have been amazing with a prompt and resourceful customer support team. They have a flexible spread on the major currency pairs and a very fast account funding process.

One more successful withdrawal of 1100€ from profits which was processed and arrived in my bank account at the same day the request was made. Impeccable service!

Amazing broker with tight spreads. Fine speed of withdrawals and deposits. Support responds very quickly to messages.

I have no problem with this broker, great broker and number 1 in the world, thanks for your awesome customer care. Deposit is instant, for withdrawal, you need only to wait for 1 banking day - it is really great news.

Fp markets is an amazing broker. Very trustworthy. You're safe with them. I didn't see any issues with them. Even for beginners, it is easy to use, and the customer service live chat is quick in replying. I would recommend it.

I am very new to this. But I try to trade and it is a good experience. FP markets are fast and responsive. I recommend FP Markets to anyone willing to trade in forex.

The customer service is excellent and you get a daily update of your account. I executed a withdrawal and it was processed promptly without issue. This will be my trading home for a long time. I will recommend this broker for everyone.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

No inactivity fees are nice, but the lack of full asset ownership is a dealbreaker for me. Worth testing, but not for everyone I think

I keep hearing FP Markets mentioned for serious traders, but I'm literally just starting out – is it going to be way too complicated for a beginner like me, or can I actually learn to use it without getting completely lost?

Honestly, FP Markets can be a bit intimidating when you're just starting out because it's really built with experienced traders in mind – those MT4, MT5, and cTrader platforms are powerful but have a steep learning curve. That said, they do offer a demo account with virtual funds where you can practice without risking real money, which is huge for beginners.

My advice? Start with their demo account and take your time learning the basics, maybe watch some YouTube tutorials on MT4 specifically since that's the most beginner-friendly of their platforms.